Are you reopening your office and wondering what your vaccination and masking polices can be? Our FAQ provides you with answers you need.

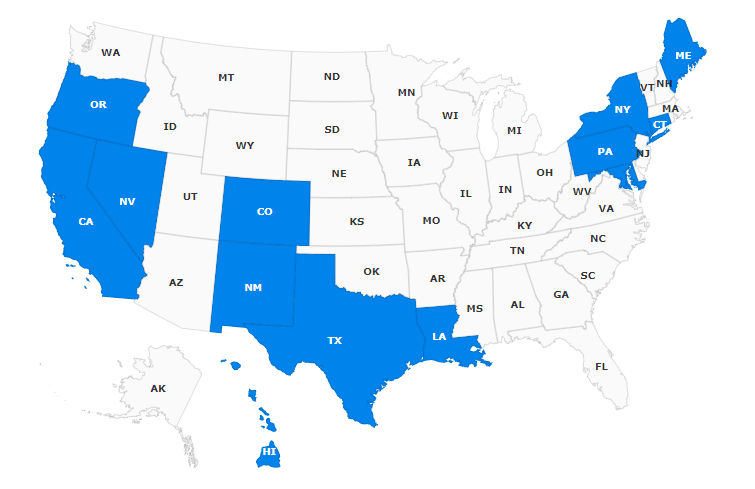

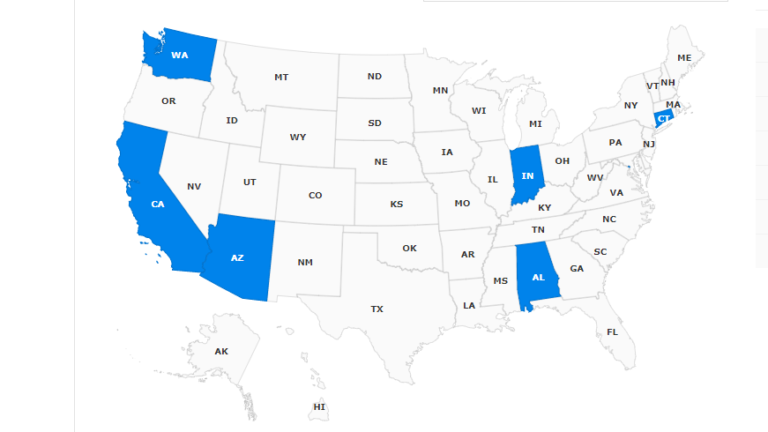

In most states, yes.* Currently the CDC suggests that fully vaccinated people do not need to wear masks in most places (some workplaces will be an exception, such as healthcare settings), but that non-fully vaccinated people should continue to wear masks and maintain social distance. OSHA has issued guidance that is in agreement with the CDC, as well as an Emergency Temporary Standard for healthcare. Additionally, some states or localities may have stricter mask requirements that should be followed. However, absent such requirements, having different rules for vaccinated vs. unvaccinated is acceptable since it is not based on a protected class.*

Treating these groups differently is generally not illegal employment discrimination* and employers should not think of it as treating employees more or less favorably, but simply as following current public health guidelines. This should also be emphasized when talking to employees about the different rules for those who are vaccinated or unvaccinated.

Keep in mind that some employees will be unvaccinated due to disability, pregnancy, or religious beliefs. Employers should be careful to ensure that these employees are not harassed because of their vaccination status (which will be obvious if they are required to wear a mask when fully vaccinated employees are not). While preventing harassment of any employee who is unvaccinated is a best practice to maintain morale and productivity in the workplace, employees who are unvaccinated for these particular reasons have protections under Title VII of the Civil Rights Act and the Americans with Disabilities Act (ADA).

*Numerous bills have been introduced at the state level to make vaccination status a protected characteristic and it appears that some Governors may create protections via Executive Order (EO). So far only Montana’s law has passed, but it appears to prevent employers not only from excluding unvaccinated workers but also from asking them to wear masks if vaccinated employees don’t have to. The current EOs (as of June 28) do not appear to impact private employers. Employers should check for state law before making policies that treat vaccinated and unvaccinated workers differently.

It depends. Unless state or local law says otherwise*, you could exclude employees from the workplace who are not vaccinated for reasons other than disability, pregnancy, or religious belief, since choosing to forgo vaccination for other reasons is not generally a protected class or characteristic.

Employers who want to exclude unvaccinated employees will need to make reasonable accommodations for employees who are unvaccinated due to disability, pregnancy, or religious belief. If there is no reasonable accommodation that would allow them to be in the workplace without posing a “direct threat,” they too could be excluded. Whether a direct threat exists, and if it can be mitigated, is extremely fact specific. The EEOC provides guidance here, in Q&A K.5. Even when you could exclude an unvaccinated employee, we generally wouldn’t recommend it.

Litigation around mandatory vaccination (which is, in effect, what an exclusion rule creates) is ramping up, and even pre-litigation expenses can add up fast. In many cases, an alternative approach of requiring unvaccinated employees to continue wearing masks and maintaining social distance will achieve similar results in term of workplace safety. That said, any approach to bringing employees back will require a workplace-specific risk assessment.

*Numerous bills have been introduced at the state level to make vaccination status a protected characteristic and it appears that some Governors may create protections via Executive Order (EO). So far only Montana’s law has passed, but it appears to prevent employers not only from excluding unvaccinated workers but also from asking them to wear masks if vaccinated employees don’t have to. The current EOs (as of June 28) do not appear to impact private employers. Employers should check for state law before making policies that exclude unvaccinated workers from the workplace.

It depends. Different treatment that is reasonably related to workplace safety – such as having non-vaccinated employees continue to wear masks – is generally okay.* Employers should make a concerted effort to only treat vaccinated and unvaccinated employees differently to the extent necessary to ensure the safety of all those in the workplace. Additionally, employers must make reasonable accommodations for employees who are unvaccinated due to disability, pregnancy, or religious belief; treating these employees differently without trying to work with them would be illegal discrimination.

Treatment that does not increase safety directly but rewards those who are vaccinated also needs to allow for accommodations for employees who can’t get vaccinated due to disability, pregnancy, or religion. For example, if you offer $100 for getting vaccinated, or throw a pizza party for vaccinated employees, an employee with a disability that prevented vaccination would need to be able to earn the $100 or attend the pizza party by doing something else that similarly advances safety in the workplace, like wearing a mask, undergoing regular COVID testing, or taking a course on preventing the spread of viruses.

While employees who are unvaccinated for reasons other than disability, pregnancy, or religion are not entitled to these kinds of accommodations, it may make sense to provide them anyway, both to encourage the alternative safety-enhancing behaviors, and to reduce the likelihood that they will complain about how they are being treated.

There is also the possibility that treating unvaccinated employees differently will have a “disparate impact” on those of a certain race or ethnicity. Disparate impact claims generally arise when an employer is trying to do something in the best interest of the company, but the methods they use ultimately harm a certain protected class. In the case of excluding unvaccinated employees, or offering cash incentives to those who are vaccinated, there could be a disparate impact on employees of color, whose vaccination rates are lagging behind those of white employees.

Employers should also ensure that unvaccinated employees are not harassed by co-workers, managers, or customers, since disability, pregnancy, and religious beliefs are protected characteristics. Although employers do not have a legal obligation to prevent harassment of employees who are unvaccinated for other reasons, it is in the best interest of the employer to prevent this, as any kind of workplace harassment is going to lead to loss of productivity, morale issues, and quite possibly bad PR.

*Numerous bills have been introduced at the state level to make vaccination status a protected characteristic and it appears that some Governors may create protections via Executive Order (EO). So far only Montana’s law has passed, but it appears to prevent employers not only from excluding unvaccinated workers but also from asking them to wear masks if vaccinated employees don’t have to. The current EOs (as of June 28) do not appear to impact private employers. Employers should check for state law before making policies that exclude unvaccinated workers from the workplace.

We recommend providing them with the CDC’s current guidance as well as any applicable state or local requirements. You can explain that the company is just doing what public health authorities recommend to keep people safe.

A waiver may or may not be useful or legally enforceable. We recommend you speak with an attorney if this is something you are interested in. A waiver will not eliminate your general duty under OSHA to provide a workplace that is free from hazards. Also, most states’ workers’ compensation laws do not allow employers to contractually limit their liability for on-the-job injuries or illnesses.

Providing advice on disease mitigation is outside of our scope of services, so we defer to guidance from the CDC and OSHA. Currently, the CDC recommends that those who are not fully vaccinated continue to wear masks in public (including the workplace) and maintain social distance, while those who are fully vaccinated may go unmasked without social distancing. OSHA has issued guidance that is in line with the CDC’s recommendations (though different rules apply in healthcare settings).

You could; masks can essentially be treated like uniforms. That said, requiring masks for those who are fully vaccinated (when not required by state or local law) is likely to cause serious morale issues and increase turnover.

Providing advice on disease mitigation is outside of our scope of services, so we defer to guidance from the CDC and OSHA. Currently, the CDC recommends that those who are not fully vaccinated continue to wear masks in public (including the workplace) and maintain social distance, while those who are fully vaccinated go unmasked without social distancing. OSHA has issued guidance that is in line with the CDC’s recommendations (though different rules apply in healthcare settings).

You may also want to consider that some vaccinated people will not be as protected as others. Those who are immunocompromised will have often get a much lower level of protection from the vaccine than the general population. Those people will therefore be at higher risk around unvaccinated people who are not wearing masks.

Employers can ask for proof of vaccination unless there is a state or local law or order to the contrary.*

When an employer is requesting or reviewing medical information in its capacity as an employer, as it would be when asking about an employee’s vaccination status, it is considered to be an employment record. In such cases, HIPAA would not apply to the employer. The ADA will govern the collection and storage of this information.

The Equal Employment Opportunity Commission (the EEOC), which enforces the ADA, has said that asking about vaccination is not a disability-related inquiry, though it could turn into one if you ask follow up questions about why the employee is not vaccinated. Asking a yes or no question, or requesting to see the employee’s vaccination card, does not violate any federal laws or require proof that the inquiry is job-related.

Finally, just because employees think that something is or should be private or confidential doesn’t mean that they can’t be required to share it with their employer. Social Security Numbers, birth dates, and home addresses are all pieces of information an employee may not want to advertise, but sharing is necessary and required. Vaccination status is similar. However, all of this information, once gathered, should not be shared by the employer with third parties, except on a need-to-know basis.

*It appears that some Governors may attempt to prevent certain entities from requiring “immunity passports” (e.g., proof of vaccination) through Executive Order, though as of June 28 none of the EOs already issued appear to apply to private businesses and their employees. Also note that if there is a law in place that prevents treating vaccinated and unvaccinated employees differently (like in Montana), you may be able to ask, but not take any action based on the response.

If you’re asking about vaccination status, you’ll want to keep some kind of record (so you don’t have to ask multiple times), but how you do so is up to you, unless state or local law has imposed recordkeeping requirements. You may want to keep something simple like an excel spreadsheet with the employee’s name and a simple “yes” or “no” in the vaccination column. If you’d prefer to take a copy of their vaccination card, that should be kept with other employee medical information, separate from their personnel file.

If state or local law requires recordkeeping, then follow those requirements, including how long the records should be kept. If no law is in play, we recommend keeping the information for as long as you keep other information in employee medical files.

Yes. We recommend not sharing this information any more widely than necessary. While anonymized information is okay to share (e.g., “80% of our employees are vaccinated!”), each employee’s vaccination status should be treated as confidential, even if the fact that they are wearing a mask to work seems to reveal their status publicly.

Obviously, managers will need this information if they are expected to enforce vaccination-dependent policies, and employers should train them on how they should be enforcing the policies and how and when to escalate issues to HR or a higher level of management.

No. The CDC differentiates between those who are fully vaccinated and everyone else. Having had COVID does not appear to provide the same level or length of immunity as the vaccine, so is not a suitable substitute when determining which safety measures should be enforced.

Theoretically, yes. However, employers will need to provide reasonable accommodation to those who are not vaccinated due to disability, pregnancy, or religion, as well as to those who are vaccinated but who will not get the same level of immunity from the shot as the general population. Additionally, since a rule like this is in direct opposition to current federal guidance, it is likely to result in complaints to OSHA, bad publicity, and lawsuits. Even if masks are not required by any law, we recommend allowing employees to wear them for any reason or no reason at all.

Our tools are designed to streamline your workday.

Schedule a Demo and see how AllMyHR works for you.