Use Code: CVD19 for 14 Days Free

Federal & State Employment Law Updates: June 2020

Seventeen states have updated their employment laws so far this month, alongside eight Federal Employment Law Updates. Our HR Advisors are versed and ready to answer all your HR questions and help your company through working remotely, coming back to work and all year long.

Labor Law Updates for June 2020

1

DOL and Pandemic’s Effects on Employees and the Workplace

On June 26, 2020, the U.S. Department of Labor released the following two Field Assistance Bulletins (FAB) to clarify issues relevant to the pandemic’s effects on employees and the workplace.

- FAB 2020-3: Schools that are physically closed in response to COVID-19 are in session under federal child labor laws for minors under 16 who are working in agricultural and nonagricultural employment. Generally, school is in session if the local, public school district requires its students to participate in virtual or distance learning, even if they are physically closed. Conversely, a physically closed school is not in session if virtual or distance learning is not required.

- FAB 2020-4: An employee may take Family First Coronavirus Response Act (FFCRA) leave if they are unable to work or telework because they need to care for their child whose place of care is closed because of COVID-19. A place of care is a physical location in which care is provided for the employee’s child while the employee works and includes summer camps and summer enrichment programs.

See all FABs

2

Form I-9 Examples for Temporary COVID-19 Policies

On June 16, 2020, the U.S. Citizenship and Immigration Services updated its webpage with the following Form I-9 examples related to temporary COVID-19 policies:

- How to notate remote inspections and subsequent physical inspections.

- How to notate extended List B documents.

These examples demonstrate how the Department of Homeland Security recommends that employers notate Form I-9 when remotely inspecting employment authorization and identity documents and then subsequently performing the required physical inspection once their normal operations resume. Employers are not required to update their Forms I-9 based on these examples if there are differences.

3

COVID-19 and Immigration Suspensions

On June 22, 2020, President Trump continued and expanded limitations on immigration during COVID-19 by signing a Proclamation Suspending Entry of Immigrants and Nonimmigrants Who Present a Risk to the U.S. Labor Market Following the Coronavirus Outbreak. This is an extension of Proclamation No. 10014, Proclamation Suspending Entry of Immigrants Who Present a Risk to the U.S. Labor Market During the Economic Recovery Following the COVID-19 Outbreak, which was originally enacted on April 22, 2020.

Accordingly, entry to the U.S. pursuant to any of the following nonimmigrant visas is prohibited:

- H-1B visa;

- H-2B visa (unrelated to temporary labor or services essential to the U.S. food supply chain);

- J visas (except for interns, trainees, teachers, camp counselors, au pairs, or in connection with a summer work travel program);

- L visas.

These proclamations include additional suspension and entry limitations (see each proclamation for the specifications) and do not apply to U.S. citizens, lawful permanent residents, or valid immigrant visa holders. Additionally, they provide exceptions for the following:

- Certain healthcare professionals critical to COVID-19;

- Those seeking U.S. entry under an EB-5 investor visa;

- U.S. citizens’ spouses and children (categories IR2, CR2, IR3, IH3, IR4, IH4);

- U.S. Armed Forces members and their spouses and children;

- Those seeking to enter the U.S. under an Afghan and Iraqi Special Immigrant Visa (SQ or SI-SIV).

- Those seeking to provide temporary labor services essential the United States food supply chain; and

- Those whose entry would be in the national interest as determined by the Secretary of State, the Secretary of Homeland Security, or their respective designees.

Routine visas services also continue to be suspended at U.S. posts worldwide as a result of the COVID-19 pandemic, but embassies and consulates may continue to provide emergency and mission-critical visa services. Mission-critical immigrant visa categories include applicants who may be eligible for an exception under these presidential proclamations, such as: IR/CR1, IR/CR2, IR/IH-3, IR/IH-4, SQ, SI, certain medical professionals, and those providing temporary labor or services essential to U.S. food supply chain, as well as cases involving an applicant who may age out of their visa category.

The extended proclamation took effect June 24, 2020 and expires December 31, 2020.

4

COVID-19 and Taxpayer Relief for Retirement Plan Distributions or Loans

On June 19, 2020, the Internal Revenue Service (IRS) released guidance for COVID-19-related distributions and loans from retirement plans under the CARES ACT. Under the CARES Act, qualified individuals may treat as COVID-19-related distributions up to $100,000 from their eligible retirement plans (including IRAs) between January 1 and December 30, 2020. A COVID-19-related distribution is:

- Not subject to the 10 percent additional tax that otherwise generally applies to distributions made before an individual reaches age 59 ½;

- Can be included in income in equal installments over a three-year period; and

- Individuals have three years to repay this distribution to a plan or IRA and undo its tax consequences.

The CARES Act also allows plans to suspend loan repayments that are due from March 27 through December 31, 2020, and the dollar limit on loans made between March 27 and September 22, 2020, is increased from $50,000 to $100,000.

As authorized under the CARES Act, the IRS guidance expands the definition of qualified individuals to anyone who:

- Is diagnosed, or whose spouse or dependent is diagnosed, with COVID-19 by a test approved by the Centers for Disease Control and Prevention (including a test authorized under the Federal Food, Drug, and Cosmetic Act); or

- Experiences adverse financial consequences because they, their spouse, or a member of their household is:

- Quarantined, furloughed or laid off, or their work hours were reduced due to COVID-19;

- Unable to work because of a lack of childcare due to COVID-19;

- Closing or reducing the hours of their owned/operated business due to COVID-19;

- Experiencing a reduction in pay or self-employment income due to COVID-19; or

- Experiencing a job offer rescission or delay in start date due to COVID-19.

Employers can choose whether to implement these COVID-19-related distribution and loan rules, and qualified individuals can claim the tax benefits of COVID-19-related distribution rules even if plan provisions are not changed. Administrators may rely on an individual’s certification that they are qualified individual (and who provides a sample certification), but an individual must also actually be a qualified individual in order to obtain favorable tax treatment. Employers have a safe harbor procedure for implementing the suspension of loan repayments otherwise due through the end of 2020, but there may be other reasonable ways to administer these rules.

Read the guidance and more on the IRS Coronavirus Tax Relief pages.

5

Supreme Court Upholds DACA

On June 18, 2020, the Supreme Court of the United States (SCOTUS) ruled, in Department of Homeland Security v. Regents of Univ. of Cal., that the Department of Homeland Security (DHS) decision to rescind the Deferred Action for Childhood Arrivals (DACA) was arbitrary and capricious under the Administrative Procedures Act. The ruling states:

“In the summer of 2012, DHS announced an immigration program known as Deferred Action for Childhood Arrivals, or DACA. That program allows certain unauthorized aliens who entered the United States as children to apply for a two-year forbearance of removal. Those granted such relief are also eligible for work authorization and various federal benefits. Some 700,000 aliens have availed themselves of this opportunity.

Five years later, the Attorney General advised DHS to rescind DACA, based on his conclusion that it was unlawful. The Department’s Acting Secretary issued a memorandum terminating the program on that basis. The termination was challenged by affected individuals and third parties who alleged, among other things, that the Acting Secretary had violated the Administrative Procedure Act (APA) by failing to adequately address important factors bearing on her decision. For the reasons that follow, we conclude that the Acting Secretary did violate the APA, and that the rescission must be vacated.”

SCOTUS’s decision was not a final resolution on the DACA program, but instead addressed the current Presidential administration’s attempt to terminate it without adequate justification. Subsequent to this holding, DACA and its protections, will remain in place pending any future legal action.

Read the ruling and archived material about DACA

6

SCOTUS Rules Federal Law Prohibits Employment Discrimination Against LGBTQ+ Employees

On June 15, 2020, the Supreme Court of the United States (SCOTUS) ruled in a landmark case, Bostock v. Clayton County, that an employer who fires an individual merely for being gay or transgender violates Title VII of the Civil Rights Act (Title VII).

Under Title VII, it is unlawful for an employer to discriminate against any individual in any employment-related benefit, term, or condition (hiring, firing, promotion, etc.) because of their race, color, religion, sex, or national origin. In this case, the court discussed that an employer violates Title VII when it intentionally fires (or refuses to hire) an individual based in part on sex. It is irrelevant if other factors, aside from the individual’s sex, contributed to the employer’s decision. This is because it is a Title VII violation if an employer intentionally relies in part on an individual employee’s sex when deciding to discharge them. In Bostock, the court held that because discrimination on the basis of homosexuality or transgender status requires an employer to intentionally treat individuals differently because of their sex, an employer who intentionally penalizes an individual for being homosexual or transgender also violates Title VII.

The court also clarified that:

- It is irrelevant what an employer might call its discriminatory practice, how others might label it, or what else might motivate it. When an employer fires an employee for being homosexual or transgender, it necessarily intentionally discriminates against that individual in part because of sex.

- An individual’s sex does not need to be the sole or primary cause of the employer’s adverse action. It is of no significance if another factor, such as an individual’s attraction to the same sex or presentation as a different sex from the one assigned at birth, might also be at work, or even play a more important role in the employer’s decision.

- Employers cannot escape liability by demonstrating it treats males and females comparably as group. An employer who intentionally fires an individual homosexual or transgender employee in part because of their sex violates the law even if the employer is willing to subject all male and female homosexual or transgender employees to the same rule.

The court clearly stated, “In Title VII, Congress adopted broad language making it illegal for an employer to rely on an employee’s sex when deciding to fire that employee. We do not hesitate to recognize today a necessary consequence of that legislative choice: An employer who fires an individual merely for being gay or transgender defies the law.”

This ruling takes immediate effect.

Read the ruling

7

Paycheck Protection Program Flexibility Act

On June 5, 2020, President Trump signed legislation (H.R. 7010) enacting the Paycheck Protection Program Flexibility Act (PPPFA), which amends the CARES Act’s Payroll Protection Program (PPP). Some of the key amendments are:

- The covered period during which borrowers must spend PPP funds was expanded to 24 weeks (from eight weeks), or by December 31, 2020, whichever is earlier. This is effective immediately and applicable to all loans as if the language were part of the original CARES Act. However, borrowers may choose to retain the eight-week covered period if they received their PPP loans prior to June 4, 2020.

- The date when workers must be rehired was extended to December 31, 2020 (originally June 30, 2020).

- Rehiring requirements were relaxed through a new loan forgiveness exemption based on employee availability from February 15 – December 31, 2020. During this time, loan forgiveness will be determined without regard to a proportional reduction in the number of full-time equivalent employees if the borrower can document in good faith that:

- They were unable to rehire former employees on February 15, 2020 and are unable to hire similarly qualified employees for unfilled positions by December 31, 2020; or

- They are unable to return to their pre-COVID-19 level of business activity (prior to February 15, 2020) because of federal safety and health requirements (issued from March 1 – December 31, 2020) for sanitation, social distancing, or any other worker or customer COVID-19-related safety requirement.

- Businesses now have five years to repay a loan and the first payment will be deferred for six months after a forgiveness determination. This is only applicable to loans made on or after June 5, 2020.

- Borrowers must now spend 60 percent of the loan on payroll (the prior allocation was 75 percent payroll and 25 for other expenses).

- Employers may delay paying Social Security payroll taxes through December 31, 2020. This is effective immediately and applicable to all loans as if the language were part of the original CARES Act.

The Small Business Association and Treasury Department are expected to release detailed guidance on the PPPFA and more.

Read US H.R. 7010.

8

Mental Health and Stress Resources

In response to the COVID-19 outbreak and subsequent fallout, the following federal resources are available to share with your employees:

- The Centers for Disease Control and Prevention’s Coping with Stress page provides information about handling the stress of an outbreak, reactions, caring for yourself and your community, who is at a higher risk, and coming out of quarantine.

- The U.S. Department of Health & Human Services (HHS) offers the following resources:

- COVID-19 Behavioral Health Resources lists a collection of resources created by federal agencies and their partners to help healthcare providers, caregivers, and the general population prepare for and manage the negative behavioral effects that can accompany a public health emergency.

- Mental Health and Coping links to resources and advice to help individuals cope and to support their mental and behavioral health during the COVID-19 pandemic. Many of these resources are available in multiple languages.

- The HHS Substance Abuse and Mental Health Services Administration (SAMHSA) COVID-19 resources page links to resources to help individuals, providers, communities, and states across the country deal with mental health challenges related to the COVID-19 pandemic.

- The Centers for Medicare & Medicaid Services (CMS) COVID-19 Partner Toolkit links to CMS and HHS materials on COVID-19.

- The National Council for Behavioral Health’s Resources for COVID-19 provides links to resources for managing mental health during COVID-19 as well as tax, loan, and leave information for employers and employees.

- The National Association of State Mental Health Program Directors COVID-19 Resource Links page provides federal government COVID-19 compliance resource links, state health department links, and more.

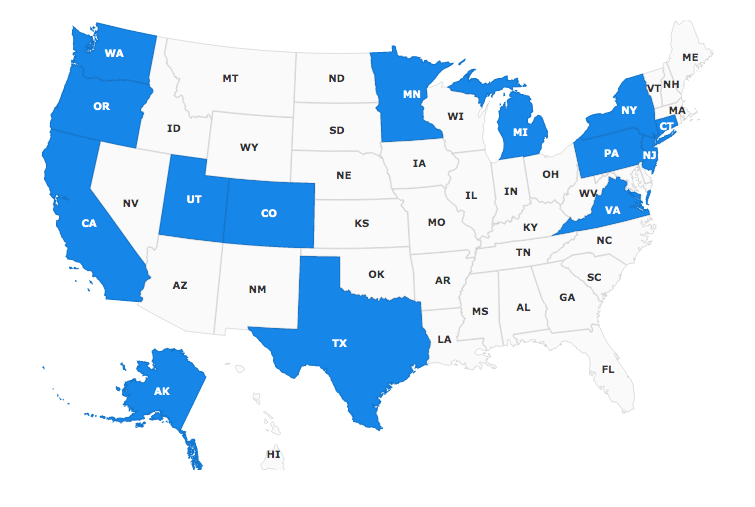

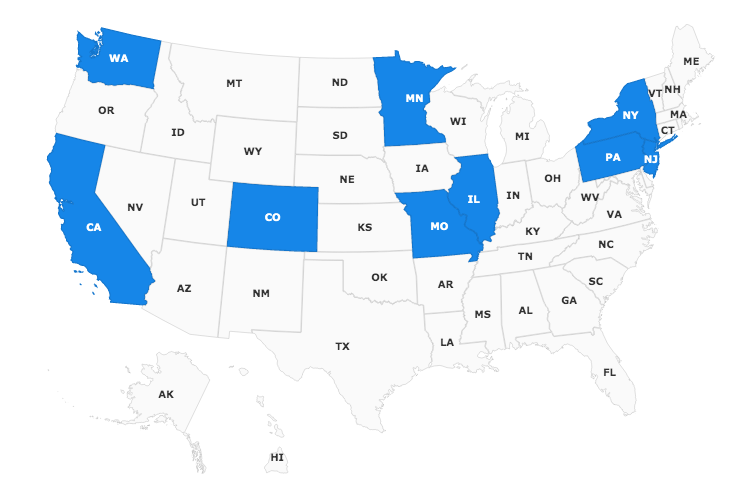

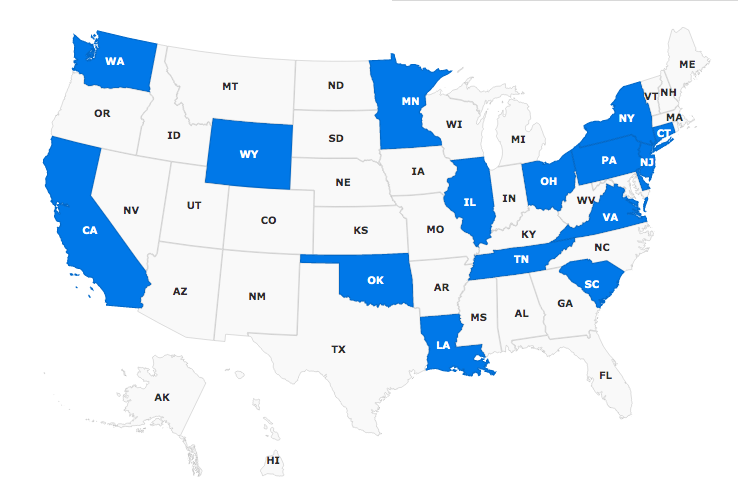

Individual State Labor Laws

State Specific Labor Law Updates

Compliance can weigh down even the most experienced professionals. Our HR Advisors, automatically updating Handbook, Compliance Database, HR Tools and Employee Training are ready to help navigate HR all year long. Everything included with your AllMyHR™ Solutions.