Let the 2020 Federal Labor Law updates commence!

It’s a brand new decade and if hindsight is 2020 (pun intended) we’re in for heavy employment law updates. Our tryHRIS HR Advisors are ready to help you navigate HR all year long.

Employment Law Updates: January 2020

1

Penalty Increases

The increased Federal Minimum Wage for Contractors and Tipped Employees became effective January 1, 2020.

On January 15, 2020, the U.S. Department of Labor published a final rule announcing an adjustment, per the Inflation Adjustment Act, to civil monetary penalties that it assesses under certain federal laws.

Some of these increases are as follows:

Employee Retirement Income Security Act (ERISA):

- Failure to furnish reports: $31 per plan year.

- Failure/refusal to properly file plan annual report: $2,233 per day.

- Failure to disclose certain documents: $1,767 per day.

- Failure to fine annual report for MEWAs: $1,625 per day.

Occupational Safety and Health Act:

- Serious violation: $13,494.

- Other-than-serious violation: $13,494.

- Willful violation: $134,937.

- Repeat violation: $134,937.

- Violation of posting requirement: $13,494.

- Failure to abate: $13,494 per day.

Family and Medical Leave Act:

- Willful violation of posting requirement: $176.

Fair Labor Standards Act:

- Repeated or willful violation of minimum wage or overtime: $2,050.

- Willful violations of wages under child labor laws: $2,050.

- Child labor violations that cause serious injury or death: $59,413.

- Willful or repeated child labor violations that cause serious injury or death: $118,826.

The final rule also increases penalties for the following federal laws:

- Migrant and Seasonal Agricultural Worker Protection Act

- Immigration and Nationality Act

- Walsh-Healey Public Contracts Act

- Employee Polygraph Protection Act

- Longshore and Harbor Workers’ Compensation Act

- Black Lung Benefits Act

The final rule is effective on January 15, 2020 and the increased penalties apply to those assessed after that date.

Read the final rule.

2

Joint Employer Final Rule

A joint employer situation occurs when an employee has two or more employers who are jointly and severally (separately) liable for wages due to the employee under the FLSA.

On January 12, 2020, the U.S. Department of Labor announced its final rule revising joint employer status under the Fair Labor Standards Act (FLSA) and adoption of a four-factor balancing test to determine joint employer status when another person benefits from an employee’s work.

Under the following four-factor balancing test, to be jointly liable the potential joint employer must actually exercise — directly or indirectly — one or more of the following control factors:

- Hire or fire the employee;

- Supervise and control the employee’s work schedule or conditions of employment to a substantial degree;

- Determine the employee’s rate and method of payment; and

- Maintain the employee’s employment records. (However, satisfaction of the maintenance of employment records factor alone does not demonstrate joint employer status.)

No single factor alone may determine whether an entity is a joint employer. Instead, the appropriate weight is given to each factor and varies depending on the circumstances.

The final rule also:

- Clarifies that an employee’s economic dependence on a potential joint employer does not determine whether it is a joint employer under the FLSA;

- Provides additional guidance on how to apply the four-factor test. For example, the other person’s ability, power, or reserved right (ability) to act in relation to the employee may be relevant for determining joint employer status, but such ability alone does not demonstrate joint employer status without some actual exercise of control (to be a joint employer the other person must actually exercise — directly or indirectly — one or more of the four control factors); and

- Specifies that an employer’s franchisor, brand and supply, or similar business model and certain contractual agreements or business practices do not make joint employer status under the FLSA more or less likely.

The final rule publishes in the Federal Register on January 16, 2020 and is effective March 16, 2020.

Read more about the final rule.

3

Federal Minimum Wage for Contractors Poster

The increased Federal Minimum Wage for Contractors and Tipped Employees became effective January 1, 2020.

In January 2020, the Federal Minimum Wage for Contractors poster was updated to reflect the minimum wage increase to $10.80 per hour that became effective on January 1, 2020. This minimum wage rate, established under Executive Order 13658, must be paid to workers performing work on or in connection with covered contracts. The poster also shows the rate, established January 1, 2019, for tipped employees performing work on or in connection with covered contracts, which is $7.55 per hour.

Employers must display this poster where employees may easily see it.

See the new official wage poster.

4

DOL Releases New Opinion Letters (FLSA and FMLA)

Three new opinion letters addressing compliance issues with both the Fair Labor Standards Act and the Family and Medical Leave Act.

On January 7, 2020, the U.S. Department of Labor (DOL) announced that it issued the following three new opinion letters that address compliance issues related to the Fair Labor Standards Act (FLSA) and the Family and Medical Leave Act (FMLA):

- FLSA2020-1: Addressing calculating overtime pay for a non-discretionary lump sum bonus paid at the end of a multi-week training period.

- FMLA2020-1-A: Addressing whether a combined general health district must count the employees of the county in which the health district is located for the purpose of determining FMLA eligibility for its employees.

- FLSA2020-2: Addressing whether per-project payments satisfy the salary basis test for exemption.

What is an Opinion Letter?

An opinion letter is an official, written opinion by the DOL’s Wage and Hour Division (WHD) regarding how a particular law applies in specific circumstances presented by the person or entity that requested the letter.

Read about these new opinion letters.

5

Fair Chance to Compete for Jobs Act of 2019

Prohibits Federal Contractors from dismissing a civil service applicant solely due to criminal history, prior to a conditional employment offer, with exceptions.

On December 20, 2019, President Trump signed legislation S. 1790, enacting the Fair Chance to Compete for Jobs Act of 2019 (Fair Chance Act). Under the act, federal contractors are prohibited from requiring that an applicant for an appointment to a position in the civil service disclose their criminal history record information before the appointing authority extends a conditional employment offer. This does not apply if consideration of an applicant’s criminal history is otherwise required by law. The act also provides other exceptions. (For example, if the applicant is applying to a federal law enforcement officer position.)

The act is effective December 20, 2021.

Read US S. 1790.

6

Final 2020 W-4 Released

The final 2020 W4 Form was released on December 5, 2019.

On December 5, 2019, the Internal Revenue Service released a final Form W-4 for use in 2020. Employees complete the Form W-4 so that their employers can withhold the correct federal tax from their paycheck.

Significant Changes from the W4 Form 2019:

A significant change for the 2020 form is that it does not have withholding allowances because employees may no longer claim personal exemptions or dependency exemptions. Previously, the value of a withholding allowance was tied to the amount of the personal exemption.

For the new form, the following five steps (as opposed to allowances) are completed by the employee to determine their withholding:

- Step 1: Personal information (including marital status).

- Step 2: Multiple jobs (employee), or whether the employee’s spouse works. This step is completed if the employee holds more than one job at a time or is married filing jointly and their spouse also works. The correct amount of withholding depends on income earned from all of these jobs.

- Steps 3 and 4: Claim dependents and (optional) other adjustments (specifically (a) other income that is not from jobs, (b) deductions, and (c) extra withholding). Steps 3 – 4(b) are completed on Form W-4 for only one job, and these steps are left blank for the other jobs. (Withholding is most accurate if an employee completes Steps 3 – 4(b) on the Form W-4 for the highest paying job.)

- Step 5: Employee signature and date (signifying that all information is true and accurate under penalty of perjury)

- Publication 15-T (still in draft form) assists employers in determining the amount of federal income tax to withhold from their employees’ wages.

Employee W-4 Requirements

Employees who have submitted Form W-4 in any year before 2020 are not required to submit a new form merely because of the redesign. Employers will continue to compute withholding based on the information from the employee’s most recently submitted Form W-4.

Read about the Form W-4, and FAQs about the form. Download the W4 Form 2020, and read about Publication 15-T.

7

Read the Remaining Five Federal Labor Law Updates

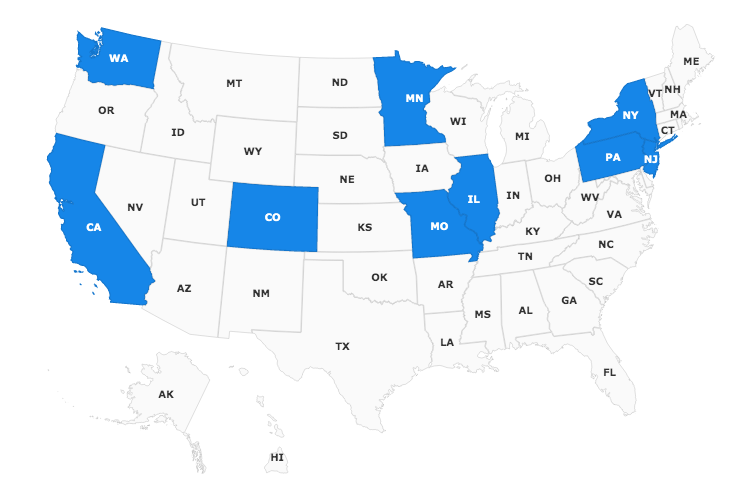

Individual State Labor Laws

State Specific Labor Law Updates:

Compliance can weigh down even the most experienced professionals. Our tryHRIS HR Advisors, one click compliance Handbook ,Compliance Database, HR Tools and Employee Training are ready to help navigate HR all year long. All for less than a latte a day.