Employment Law Updates: November 2021

Three Federal, one District of Columbia, and ten State Law Updates have been issued this month. Our HR Advisors are versed and ready to answer your toughest HR questions to help your company through working remotely, coming back to work and all year long.

Federal Labor Law Updates:

1

2022 Increase to Federal Contractor Minimum Wage

- Increases the hourly minimum wage for certain federal contractors to $15 beginning January 30, 2022, with future inflation-based increases.

- Eliminates the tipped minimum wage for federal contractors by 2024.

- Ensures a $15 minimum wage for workers with disabilities performing work on or in connection with covered contracts.

- Restores minimum wage protections to outfitters and guides operating on federal lands.

(Announced by DOL on November 22, 2021)

2

EEOC Addresses Employer Retaliation in its COVID-19 “What You Should Know”

On November 17, 2021, the Equal Employment Opportunity Commission (EEOC) updated its What You Should Know About COVID-19 and the ADA, the Rehabilitation Act, and Other EEO Laws (“What You Should Know”) to include more about employer retaliation in pandemic-related employment situations.

The updates clarify the rights of employees and applicants who think they were retaliated against because of protected activities under the Americans with Disabilities Act (ADA), Title VII of the Civil Rights Act, or other employment discrimination laws, in relation to employer- mandated COVID-19 health and safety protocols. Key updates include:

- Applicants and current and former employees are protected from employer retaliation when they assert their rights under any of the EEOC-enforced anti-discrimination laws.

- Protected activity can take many forms, including:

– Filing a discrimination charge;

– Complaining to a supervisor about coworker harassment; or

– Requesting accommodation of a disability or a religious belief, practice, or observance, regardless of whether it’s granted or denied. - That the ADA prohibits not only retaliation for protected EEO activity, but also “interference” with an individual’s exercise of ADA rights.

The updates also support the EEOC’s participation in an interagency initiative—launched on the same day as these updates—to end retaliation against workers who exercise their protected labor and employment law rights. Other participants in the initiative include the U.S. Department of Labor (DOL) and the National Labor Relations Board (NLRB). The EEOC, DOL, and NLRB will collaborate to protect workers against unlawful retaliatory conduct, educate the public, and engage with employers, business organizations, labor organizations, and civil rights groups in the coming year.

Of note, the EEOC has updated its “What You Should Know” approximately 20 times throughout the pandemic.

3

OSHA Will Not Enforce Vaccination ETS Pending Further Litigation

According to the Occupational Safety and Health Administration (OSHA) website:

“On November 12, 2021, the U.S. Court of Appeals for the Fifth Circuit granted a motion to stay OSHA’s COVID-19 Vaccination and Testing Emergency Temporary Standard, published on November 5, 2021 (86 Fed. Reg. 61402) (ETS). The court ordered that OSHA “take no steps to implement or enforce” the ETS “until further court order.” While OSHA remains confident in its authority to protect workers in emergencies, OSHA has suspended activities related to the implementation and enforcement of the ETS pending future developments in the litigation.”

State Specific Labor Law Updates:

Compliance can weigh down even the most experienced professionals. Our HR Advisors, one click compliance Handbook, Compliance Database, HR Tools and Employee Training are ready to help navigate HR all year long. Everything included with your AllMyHR Solutions.

Previous Labor Laws & Information

30-Day Money-Back Guarantee

COVID-19 Vaccine Mandate News and FAQ

The President’s COVID-19 Action Plan

The ETS will also require employers with more than 100 employees to provide paid time off for workers to get vaccinated or recover from vaccination.

We are actively monitoring for the details of President Biden’s COVID action plan. Here is what we know and don’t know:

What We Know

- The mandate applies to employers with 100+ employees.

- It requires mandatory vaccination or weekly testing to come into work.

- It also requires paid time off to get vaccinated and recover.

- Fines will be assessed.

- If you have fewer than 100 employees, no federal contracts, and no healthcare workers, these new federal requirements do NOT apply to you.

What We Don’t Know

- How do employers count to 100?

- Do remote employees have to get vaccinated or tested?

- What kind of proof do employers need to require?

- Do employers need to do “due diligence”?

- Will testing be done at home or at work?

- Who pays for testing?

- Will there be any funds or tax credits available?

- What are the recordkeeping requirements?

- Can employees claim religious exemptions from testing?

- How will fines be assessed?

- Will OSHA have the staff to enforce this?

FAQ

- Put someone in charge of the whole process and make sure that complaints go to them. Don’t count on your frontline managers to know how to deal with escalations. They aren’t trained for that, and it’s not fair to them.

- Emphasize that this is a federal government requirement and that you have no choice about whether or not to comply. You can also emphasize that penalties may be very steep – so steep that even one or two violations could put the business in jeopardy.

- Focus on the fact that this is about safety. If employees don’t want a vaccination, there is a simple alternative, but in order to ensure that the workplace is safe with highly infectious Delta making the rounds, vaccination or testing must be done.

We recommend speaking with your clients about possible accommodations for those employees who request an accommodation for a disability or sincerely held religious belief. Federal law generally requires employers to provide accommodations for employees for these reasons unless doing so would cause an undue hardship. There isn’t an exception for client requirements, which puts you between a rock and a hard place.

The first step is asking your client about potential exceptions to their mandatory vaccination requirement. If your client says that they will not grant any exceptions, we recommend placing employees who require a religious or disability accommodation with a different client. If all your clients require employees to be vaccinated without exceptions, possible accommodations might be to reassign the employee to a vacant position that they‘re qualified for or to place the employee on a leave of absence. Either way, you should discuss the available options with the employee.

If the only option is leave, you’ll want to discuss the length of leave with the employee (it might be temporary, as with pregnancy). The estimated duration will help you evaluate whether granting leave would cause an undue hardship.

- The Delta variant is twice as contagious as original COVID.

- Fewer people have a cough or loss of smell, more people have headaches, sort throats, and runny noses (looks more like the common cold).

- It appears that Delta may cause more severe illness in unvaccinated people than the original.

- Delta appears more likely to cause breakthrough infections for the fully vaccinated, but the vaccines remain highly effective against severe illness, hospitalization, and death from Delta.

- When a vaccinated person catches Delta, their viral load is as high as an unvaccinated person for a time (unlike earlier strains of COVID), but it goes down faster than for the unvaccinated, so they will be infectious for shorter periods of time.

Assuming no state law or collective bargaining agreement prohibits it, employers can generally require employees to get the COVID-19 vaccine as a condition of continued employment, although they may need to make exceptions for employees who can’t get vaccinated because of a sincerely held religious belief, disability, or possibly pregnancy.

Religious Belief

Title VII of the Civil Rights Act of 1964 requires employers that have 15 or more employees to accommodate employees’ religious beliefs that are sincerely held if it doesn’t create an undue hardship. Title VII defines religion very broadly. It includes traditional, organized religions such as Christianity, Judaism, Islam, Hinduism, and Buddhism. It also includes religious beliefs that are new, uncommon, not part of a formal church or sect, or only held by a small number of people or possibly just one person.

Here’s the basic framework. If the answer is no to any question, generally no accommodation is required; if the answer is yes to all questions, an accommodation is required.

- Does the person have a belief that is religious?

- Is the belief sincerely held?

- Can an accommodation be made that would enable the employee to do the job, without creating an undue hardship?

According to the Equal Employment Opportunity Commission (EEOC), employers should generally assume that the employee’s religious belief is sincerely held, but if “they have an objective basis for questioning either the religious nature or the sincerity of a particular belief or practice, the employer would be justified in seeking additional supporting information.”

Under Title VII, undue hardship is defined as “more than a de minimis cost.” The EEOC explains this further in its guidance here.

Disability

The Americans with Disabilities Act (ADA) generally requires employers to provide accommodations to employees who have disabilities to enable them to perform the essential functions of their job, provided the accommodation doesn’t create an undue hardship. The definition of disability under the ADA is pretty broad and includes both physical and mental disabilities.

If an employee requests an exception to your mandatory vaccination policy because of a disability, then you would be required to engage in the interactive process. The interactive process is essentially an ongoing conversation with the employee to explore potential accommodations. You can require the employee to provide documentation from their health care provider confirming that the employee’s health condition prevents them from getting vaccinated and, if temporary, an estimate of the expected duration of the need for the accommodation.

The company would then determine whether it’s possible to make an accommodation that would enable them to perform their essential functions without creating an undue hardship.

Safety Assessment

Companies who are considering excluding unvaccinated employees from the workplace will ultimately need to assess whether allowing an employee to be unvaccinated, while engaging in other safety measures, would pose a direct threat in the workplace.

We recommend reviewing the EEOC’s guidance on what qualifies as a direct threat before making this determination. If you conclude that allowing an employee to remain unvaccinated rises to the level of a direct threat, then you are required to evaluate whether potential accommodations would eliminate that threat or reduce it enough so that it no longer meets the standard of being a direct threat. If no accommodations exist that would reduce the threat sufficiently (without creating an undue hardship), then you wouldn’t be required to make an exception for the employee.

If you believe there is no accommodation that will make it safe enough for that employee to be in the workplace, and they are not able to work from home, we recommend working with an attorney to assess the risk of termination or exclusion from the workplace.

Documentation

Employers should keep documentation as to how their determination to grant or deny a request for an exception to their mandatory vaccination requirement was made, which could include:

- Accommodation request form and supporting documentation, if any

- Emails to/from the employee about their request

- Notes on the employer’s decision-making process

Title VII of the Civil Rights Act of 1964 requires employers that have 15 or more employees to accommodate religious beliefs that are sincerely held if it doesn’t create an undue hardship. Title VII defines “religion” very broadly. It includes traditional, organized religions such as Christianity, Judaism, Islam, Hinduism, and Buddhism. It also includes religious beliefs that are new, uncommon, not part of a formal church or sect, only held by a small number of people (and maybe even just one person).

We understand it can be challenging when you’ve received a religious accommodation request that you have reason to doubt. We’re happy to give some general guidance but are unable to give definitive guidance as to whether this employee has a sincerely held religious belief or whether you would be required to provide an accommodation in this situation. We recommend speaking to legal counsel to help you make this determination.

According to the Equal Employment Opportunity Commission (EEOC), employers should generally assume that the employee’s religious belief is sincerely held, but if “they have an objective basis for questioning either the religious nature or the sincerity of a particular belief or practice, the employer would be justified in seeking additional supporting information.”

Typically, the following are not considered religious beliefs and therefore don’t require an exemption from your mandatory vaccination policy:

- Political beliefs (e.g., “Vaccination infringes on my personal liberty.”)

- Personal preferences (e.g., “I prefer to risk getting COVID rather than getting vaccinated.”)

- Medical beliefs (e.g., “COVID isn’t that bad.”)

- Concerns about the vaccine’s Emergency Use Authorization (EUA) status (if the employee can’t access a vaccine with regular FDA approval)

- Conspiracy theories (e.g., “COVID is a hoax.”)

Please note that there could be overlap between a sincerely held religious belief and another belief, such as a political belief—that overlap does not place it outside the scope of Title VII’s religious protections.

We recommend documenting the information you used to make an accommodation decision.

Our tools are designed to streamline your workday.

Schedule a Demo and see how AllMyHR works for you.

Employment Law Updates: October 2021

Employment Law Updates: October 2021

One Federal and 14 State Law Updates have been issued this month. Our HR Advisors are versed and ready to answer your toughest HR questions to help your company through working remotely, coming back to work and all year long.

Federal Law Update

EEOC Updates to COVID-19 Vaccination Guidance

On October 13, 2021, the Equal Employment Opportunity Commission updated its guidance about:

- COVID-19 Vaccinations: EEO Overview (K.1 and K.3)

- The ADA and COVID-19 Vaccinations (K.4 and K.9)

- Title VII and COVID-19 Vaccinations (K.13)

- GINA and COVID-19 Vaccinations (K.15)

- Employer Incentives for COVID-19 Voluntary Vaccinations Under ADA and GINA (K.16, K.17, and K.18)

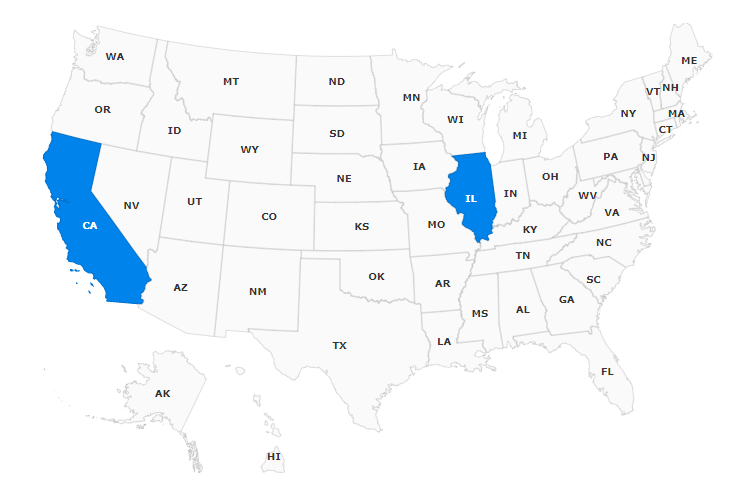

Individual state labor laws

State Specific Labor Law Updates:

Compliance can weigh down even the most experienced professionals. Our HR Advisors, one click compliance Handbook, Compliance Database, HR Tools and Employee Training are ready to help navigate HR all year long. Everything included with your AllMyHR Solutions.

Previous Labor Laws & Information

30-Day Money-Back Guarantee

Employer Medicare Part D Notices Are Due Before October 15, 2021

Purpose

Medicare began offering “Part D” plans — optional prescription drug benefit plans sold by private insurance companies and HMOs — to Medicare beneficiaries many years ago. People may enroll in a Part D plan when they first become eligible for Medicare.

If they wait too long, a late enrollment penalty amount is permanently added to the Part D plan premium cost when they do enroll. There is an exception, though, for individuals who are covered under an employer’s group health plan that provides creditable coverage. (“Creditable” means that the group plan’s drug benefits are actuarially equivalent or better than the benefits required in a Part D plan.) In that case, the individual can delay enrolling for a Part D plan while he or she remains covered under the employer’s creditable plan. Medicare will waive the late enrollment premium penalty for individuals who enroll in a Part D plan after their initial eligibility date if they were covered by an employer’s creditable plan. To avoid the late enrollment penalty, there cannot be a gap longer than 62 days between the creditable group plan and the Part D plan.

To help Medicare-eligible plan participants make informed decisions about whether and when to enroll in a Part D drug plan, they need to know if their employer’s group health plan provides creditable or noncreditable prescription drug coverage. That is the purpose of the federal requirement for employers to provide an annual notice (Employer’s Medicare Part D Notice) to all Medicare-eligible employees and spouses.

Employer Requirements

Federal law requires all employers that offer group health coverage including any outpatient prescription drug benefits to provide an annual notice to plan participants.

The notice requirement applies regardless of the employer’s size or whether the group plan is insured or self-funded:

- Determine whether your group health plan’s prescription drug coverage is creditable or noncreditable for the upcoming year (2022). If your plan is insured, the carrier/HMO will confirm creditable or noncreditable status. Keep a copy of the written confirmation for your records. For self-funded plans, the plan actuary will determine the plan’s status using guidance provided by the Centers for Medicare and Medicaid Services (CMS).

- Distribute a Notice of Creditable Coverage or a Notice of Noncreditable Coverage, as applicable, to all group health plan participants who are or may become eligible for Medicare in the next year. “Participants” include covered employees and retirees (and spouses) and COBRA enrollees. Employers often do not know whether a particular participant may be eligible for Medicare due to age or disability. For convenience, many employers decide to distribute their notice to all participants regardless of Medicare status.

- Notices must be distributed at least annually before October 15. Medicare holds its Part D enrollment period each year from October 15 to December 7, which is why it is important for group health plan participants to receive their employer’s notice before October 15.

- Notices also may be required after October 15 for new enrollees and/or if the plan’s creditable versus noncreditable status changes.

Preparing the Notice(s)

Model notices are available on the CMS website. Start with the model notice and then fill in the blanks and variable items as needed for each group health plan. There are two versions: Notice of Creditable Coverage or Notice of Noncreditable Coverage and each is available in English and Spanish:

- Model Notice for Group Plan that is Creditable Coverage (English)

- Model Notice for Group Plan that is Noncreditable Coverage (English)

- Model Notice for Group Plan that is Creditable Coverage (Spanish)

- Model Notice for Group Plan that is Noncreditable Coverage (Spanish)

Employers who offer multiple group health plan options, such as PPOs, HDHPs, and HMOs, may use one notice if all options are creditable (or all are noncreditable). In this case, it is advisable to list the names of the various plan options so it is clear for the reader. Conversely, employers that offer a creditable plan and a noncreditable plan, such as a creditable HMO and a noncreditable HDHP, will need to prepare separate notices for the different plan participants.

Distributing the Notice(s)

You may distribute the notice by first-class mail to the employee’s home or work address. A separate notice for the employee’s spouse or family members is not required unless the employer has information that they live at different addresses.

The notice is intended to be a stand-alone document. It may be distributed at the same time as other plan materials, but it should be a separate document. If the notice is incorporated with other material (such as stapled items or in a booklet format), the notice must appear in 14-point font, be bolded, offset, or boxed, and placed on the first page. Alternatively, in this case, you can put a reference (in 14-point font, either bolded, offset, or boxed) on the first page telling the reader where to find the notice within the material. Here is suggested text from the CMS for the first page:

“If you (and/or your dependents) have Medicare or will become eligible for Medicare in the next 12 months, a federal law gives you more choices about your prescription drug coverage. Please see page XX for more details.”

Email distribution is allowed but only for employees who have regular access to email as an integral part of their job duties. Employees also must have access to a printer, be notified that a hard copy of the notice is available at no cost upon request, and be informed that they are responsible for sharing the notice with any Medicare-eligible family members who are enrolled in the employer’s group plan.

CMS Disclosure Requirement

Separate from the participant notice requirement, employers also must disclose to the CMS whether their group health plan provides creditable or noncreditable coverage. To submit your plan’s disclosure, use the CMS online tool and follow the prompts. The process usually takes only 5 or 10 minutes to complete. It is due with 60 days after the start of the plan year; for instance, for calendar year plans that will be March 1, 2022. If the plan’s prescription drug coverage ends or its status as creditable or noncreditable changes, submit a new disclosure within 30 days of the change.

Our tools are designed to streamline your workday.

Schedule a Demo and see how AllMyHR works for you.

Employment Law Updates: September 2021

Employment Law Updates: September 2021

Five Federal and three State Law Updates have been issued this month. Our HR Advisors are versed and ready to answer your toughest HR questions to help your company through working remotely, coming back to work and all year long.

Federal Labor Law Update for September 2021

1

Final Tip Rule

On September 23, 2021, the U.S Department of Labor (DOL) announced that the publication of its Tips CMP final rule will be on the 24th, and under it:

- The DOL can assess penalties—of up to $1,100 per violation—against employers who take the tips their employees earned, regardless of whether it was repeated or willful; and

- The 2020 Tip final rule was clarified by explaining that although managers and supervisors are prohibited from receiving tips from mandatory tip pools, they can contribute to them for eligible employees.

The final rule is effective November 23, 2021.

2

OSHA Expands its Protections from Extreme Heat

On September 20, 2021, the federal Occupational Safety and Health Administration (OSHA) announced its new:

- Heat-related hazards enforcement initiative.

- National Emphasis Program on heat hazard cases, which will target high-risk industries and focus agency resources and staff time on heat inspections. The 2022 National Emphasis Program will build on the existing Regional Emphasis Program for Heat Illnesses in OSHA’s Region VI, which covers Arkansas, Louisiana, New Mexico, Oklahoma and Texas.

- Rulemaking process to develop a workplace heat standard in October 2021.

- National Advisory Committee on Occupational Safety and Health Heat Injury and Illness Prevention Work Group.

OSHA also recently implemented an intervention and enforcement initiative to prevent and protect workers from heat-related illnesses and deaths while they are working in hazardous hot environments that:

- Prioritizes heat-related interventions and inspections of work activities on days when the heat index exceeds 80 degrees Fahrenheit; and

- Applies to indoor and outdoor worksites in general industry, construction, agriculture, and maritime where potential heat-related hazards exist.

On days when a recognized heat temperature can result in increased risks of heat-related illnesses, OSHA will increase its enforcement efforts. Employers are also encouraged to implement intervention methods on heat priority days proactively, including regularly taking breaks for water, rest, shade, training workers on how to identify common symptoms and what to do when a worker suspects a heat-related illness is occurring, and taking periodic measurements to determine workers’ heat exposure.

OSHA has required its Area Directors across the nation to institute the following:

- Prioritize inspections of heat-related complaints, referrals, and employer- reported illnesses and initiate an onsite investigation where possible.

- Instruct compliance safety and health officers, during their travels to job sites, to conduct an intervention (providing the agency’s heat poster/wallet card, discuss the importance of easy access to cool water, cooling areas, and acclimatization) or open an inspection when they observe employees performing strenuous work in hot conditions.

- Expand the scope of other inspections to address heat-related hazards where worksite conditions or other evidence indicates these hazards may be present.

President Biden also released a statement about mobilizing the administration to address extreme heat.

3

Long COVID as a Disability

On September 9, 2021, the EEOC announced that it recognizes that long COVID may be a disability under the Americans with Disabilities Act (ADA) and Section 501 of the Rehabilitation Act in certain circumstances. The EEOC agreed with the analysis of “long COVID” by the Department of Health and Human Services (HHS) and Department of Justice (DOJ) in their “Guidance on ‘Long COVID’ as a Disability Under the ADA, Section 504, and Section 1557.” The EEOC will release technical assistance about COVID-19 and ADA “disability” in the employment context in the coming weeks. On August 2, 2021, the White House, HHS, Department of Education, and Department of Labor also hosted “A Conversation about Long COVID,” reviewing and providing support to the HHS and DOJ guidance.

Brief Summary of HHS and DOJ Guidance

According to the guidance, long COVID is a disability under the:

- ADA (Titles II and III at 42 U.S.C. §§ 12101-12103, and 12131-12189);

- Section 504 of the Rehabilitation Act of 1973 (29 U.S.C. § 794); and

- Section 1557 of the Patient Protection and Affordable Care Act (42 U.S.C. § 18116).

Note: Read more on the Office of Disability Employment Policy’s JAN website about long COVID and the ADA.

Person with a Disability

A person with a disability is someone:

- With a physical or mental impairment that substantially limits one or more of their major life activities;

- With a record of such an impairment; or

- Who is regarded as having such an impairment.

What is an Impairment

A person with long COVID has a disability if their condition or any of its symptoms is a physical or mental impairment that substantially limits one or more major life activities. A physical impairment includes any physiological disorder or condition affecting one or more body systems, including, among others, the neurological, respiratory, cardiovascular, and circulatory systems. A mental impairment includes any mental or psychological disorder, such as an emotional or mental illness. Long COVID is a physiological condition affecting one or more body systems. For example, some people with long COVID experience:

- Lung damage

- Heart damage, including inflammation of the heart muscle

- Kidney damage

- Neurological damage

- Damage to the circulatory system resulting in poor blood flow

- Lingering emotional illness and other mental health conditions

Accordingly, long COVID is a physical or mental impairment under the ADA, Section 504, and Section 1557.

What is a Major Life Activity

Long COVID can substantially limit one or more major life activities, which include a wide range of activities, such as caring for oneself, performing manual tasks, seeing, hearing, eating, sleeping, walking, standing, sitting, reaching, lifting, bending, speaking, breathing, learning, reading, concentrating, thinking, writing, communicating, interacting with others, and working. It also includes the operation of a major bodily function, such as the functions of the immune system, cardiovascular system, neurological system, circulatory system, or the operation of an organ.

What Substantially Limits

To “substantially limit” is construed broadly under these laws and shouldn’t require extensive analysis. The impairment doesn’t need to prevent or significantly restrict an individual from performing a major life activity, and the limitations don’t need to be severe, permanent, or long-term. Whether an individual with long COVID is substantially limited in a major bodily function or other major life activity is determined without the benefit of any medication, treatment, or other measures used by the individual to lessen or compensate for symptoms. Even if the impairment comes and goes, it is considered a disability if it would substantially limit a major life activity when the impairment is active.

Long COVID can substantially limit a major life activity and when someone with long COVID might be substantially limited in a major life activity are varied, for instance:

- A person with long COVID who has lung damage that causes shortness of breath, fatigue, and related effects is substantially limited in respiratory function, among other major life activities.

- A person with long COVID who has symptoms of intestinal pain, vomiting, and nausea that have lingered for months is substantially limited in gastrointestinal function, among other major life activities.

- A person with long COVID who experiences memory lapses and “brain fog” is substantially limited in brain function, concentrating, and/or thinking.

However, long COVID isn’t always a disability. It requires an individualized assessment to determine whether a person’s long COVID condition or any of its symptoms substantially limits a major life activity.

Protections

People whose long COVID qualifies as a disability are entitled to the same rights and protections from discrimination as any other person with a disability under the ADA, Section 504, and Section 1557 (full and equal opportunities to participate in and enjoy all aspects of civic and commercial life).

4

Vaccinations or Weekly Testing Required for All Employers with 100+ Employees, Paid Time Off, and More

On September 9, 2021, President Biden released his COVID-19 Action Plan requiring all employers with 100 or more employees to ensure their workers are vaccinated or tested weekly. According to the President, “The Department of Labor’s Occupational Safety and Health Administration (OSHA) is developing a rule that will require all employers with 100 or more employees to ensure their workforce is fully vaccinated or require any workers who remain unvaccinated to produce a negative test result on at least a weekly basis before coming to work. OSHA will issue an Emergency Temporary Standard (ETS) to implement this requirement.”

OSHA is also developing an additional ETS requiring employers with more than 100 employees to provide paid time off for workers to get vaccinated or recover from vaccination. The administration is preparing for boosters to start the week of September 20th, subject to authorization or approval by the FDA and a recommendation from the Advisory Committee on Immunization Practices.

The President’s plan also calls on entertainment venues like sports arenas, large concert halls, and other venues where large groups of people gather to require that their patrons be vaccinated or show a negative test for entry.

We will provide more information about these new rules when they are released.

5

IRS Guidance on Reporting Qualified Sick and Family Leave Wages for 2021

On September 7, 2021, the Internal Revenue Service issued Notice 2021-53 to help employers with their Form W-2 reporting and the amount of qualified sick and family leave wages paid to employees for the leave they took in 2021 under the Families First Coronavirus Response Act (FFCRA), as amended by the COVID-Related Tax Relief Act of 2020, and the American Rescue Plan Act of 2021. Employers must report these wage amounts to employees either on Form W-2, Box 14, or in a separate statement provided with the W-2.

The guidance also contains model language (starting on page 18) that employers can use—as part of the Instructions for Employee for the Form W-2 or on the separate statement provided with the W-2—to explain to employees that these qualified sick and family leave wages may limit the amount of qualified sick leave equivalent or qualified family leave equivalent credits they may be entitled to for any of their self-employment income. The wage amount required by the notice on the Form W-2 will give employees who are also self- employed the information they need to figure out the amount of any sick and family leave equivalent credits they may claim in their self-employed capacities.

Of note, in July 2020, the IRS issued Notice 2020-54 with guidance about W-2 reporting of qualified sick leave and family leave under FFCRA for wages paid to employees for leave taken in 2020. The IRS has more tax relief information for employers affected by the COVID-19 pandemic on its website.

Individual state labor laws

State Specific Labor Law Updates:

Compliance can weigh down even the most experienced professionals. Our HR Advisors, one click compliance Handbook, Compliance Database, HR Tools and Employee Training are ready to help navigate HR all year long. Everything included with your AllMyHR Solutions.

Previous Labor Laws & Information

30-Day Money-Back Guarantee

Federal Law Alert: September 2021

Federal Law Alert: September 2021

One Federal Law Alert has been issued so far this month.

Compliance can weigh down even the most experienced professionals. Our HR Advisors, one click compliance Handbook, Compliance Database, HR Tools and Employee Training are ready to help navigate HR all year long. Everything included with your AllMyHR Solutions.

Previous Labor Laws & Information

30-Day Money-Back Guarantee

Onboarding Starts Before a New Hire’s First Day

Pre-Employment Communication

New hires are often overwhelmed on their first day – especially when the orientation program includes long lists of procedures, tasks, company policies, introductions to co-workers, compliance requirements, and all the technical aspects of employment. It’s difficult for new hires to absorb and retain much of the information conveyed during orientation, this is why follow up is critical.

So first-day orientation, while important, isn’t the end of onboarding. Onboarding is a larger process that begins before the start date and continues through most of the first year, done properly it will provide a seamless, efficient and effective new hire experience.

It All Begins Here

Remember when you started. When did you receive and sign your offer letter? How soon did you start? Did you have communication between your hire and start dates? If there was communication, what form was it in? What did it say? What materials were provided? Hopefully you received a reminder to bring valid identification as well as signed copies of employment documentation (offer letter, employee handbook acknowledgment, I9, and a W4).

Onboarding documents, such as a Welcome Packet, are sent as part of the series of communication before your employee’s start date. These documents provide an overview to help set expectations. They also give your new hire time to review information and arrive for their first day prepared and ready!

Standardized new hire onboarding communication decreases the work and relieves much of the effort creating this experience for each new hire. This will also help you build a consistently reinforced employer brand with each new employee.

While some items in the onboarding process can be conveyed via bullet points in an email (direct deposit setup, background check, dress code, etc.) others need to be more thoroughly and clearly communicated. The Welcome Packet you create does just that.

A Good Heads-up Will Lower Anxiety

We like the Golden Rule when it comes to a new employee orientation checklist: When starting a new job, would you want your new company to send you a generic welcome email before your first day, or more personalized and detailed information to get you ready for your new position.

Provide new employees with a sense of transparency with the materials your company provides in their Welcome Packet. Include information to give them a heads-up (maybe refrigerator lunchroom rules or the temperature in the office). When appropriate an email introduction to team members or a request for a short personal bio for a welcome announcement to the company.

Providing a snapshot of coworkers (just the basics) first name, face, and function. These basic three can prove to be helpful when your new hire first meets their coworkers. This information can also help lower anxiety.

Day 1

New hire expects an HR orientation on their first day. How long will orientation take 60 minutes, a full workday? What needs to be covered? What questions should be asked? These are the types of things new hires are thinking about. Introductions, new hire paperwork, lines of communication, different team members, understanding the new role and expectations of performance are all unanswered question new hires want and need to know.

Start by sending Welcome Packets a week before the new hire start date. This provides basic information and answers questions and concerns before that often stressful first day.

As we all know, first impressions matter! The first day is a major part of the onboarding process. This is where your company makes its first impression. This is why it’s essential to get things off to a proper start. Providing a detailed look at the agenda will keep you and your new hire on the same page and help ease the stresses of day one.

Six Months

Onboarding is about employee perception and experience, providing a platform for successful employment. It doesn’t stop after the first day. It’s not unusual for new hires to take as much as 6 months to a year to fully get up and running in all aspects of their new employment. The all important 90 day review should include a review with not just the employees manager but with the HR department. This provides the perfect opportunity to ask about their experience and opinion of the onboarding process.

This is why it’s important to have a plan that extends out 90 days to as long as 6 months.

Conclusion

Once the onboarding is complete, check for understanding, track your results, examine any gaps, incorporate feedback to improve your future Welcome Packets.

Our tools are designed to streamline your workday.

Schedule a Demo and see how AllMyHR works for you.

Employment Law Updates: August 2021

Employment Law Updates: August 2021

One Federal and two State Law Updates have been issued this month. Our HR Advisors are versed and ready to answer your toughest HR questions to help your company through working remotely, coming back to work and all year long.

Federal Labor Law Update for August 2021

1

COVID-19 Booster Shots

2

OSHA Updates Coronavirus Guidance

On August 13, 2021, the Occupational Safety and Health Administration issued updated guidance to help employers protect workers from the coronavirus. The updated guidance reflects developments in science and data, including the Centers for Disease Control and Prevention’s updated COVID-19 guidance issued July 27, 2021.

The updated guidance expands information on appropriate measures for protecting workers in higher-risk workplaces with mixed-vaccination status workers, particularly for industries such as manufacturing; meat, seafood and poultry processing; high volume retail and grocery; and agricultural processing, where there is often prolonged close contact with other workers and/or non-workers.

OSHA’s latest guidance:

- Recommends that fully vaccinated workers in areas of substantial or high community transmission wear masks in order to protect unvaccinated workers;

- Recommends that fully vaccinated workers who have close contacts with people with coronavirus wear masks for up to 14 days unless they have a negative coronavirus test at least three to five days after such contact;

- Clarifies recommendations to protect unvaccinated workers and other at-risk workers in manufacturing, meat and poultry processing, seafood processing and agricultural processing; and

- Links to the latest guidance on K-12 schools and CDC statements on public transit.

According to OSHA, vaccination is the optimal step to protect workers and encourages employers to engage with workers and their representatives to implement multi-layered approaches to protect unvaccinated or otherwise at-risk workers from the coronavirus.

OSHA also reviews the COVID-19 Healthcare Emergency Temporary Standard every 30-days and its safeguards remain more important than ever. After reviewing the latest guidance, science and data, and consulting with the CDC and partners, OSHA determined the requirements of the healthcare ETS remain necessary to address the danger of the coronavirus in healthcare. OSHA will continue to monitor and assess the need for changes in the healthcare ETS each month.

Individual state labor laws

State Specific Labor Law Updates:

Compliance can weigh down even the most experienced professionals. Our HR Advisors, one click compliance Handbook, Compliance Database, HR Tools and Employee Training are ready to help navigate HR all year long. Everything included with your AllMyHR Solutions.

Previous Labor Laws & Information

30-Day Money-Back Guarantee

HR Compliance: What It Is and Why It’s So Complicated

Running a business comes with no shortage of perks. You get the freedom to be your own boss, invest in an idea, steer its trajectory, and create wealth. It has its challenges, too. Competition may be fierce. Demand for what you offer may be low. Costs may not be sustainable. But even if everything else is going your way, there’s one challenge that’s ever-present. We’re talking, of course, about HR compliance.

The Definition of HR Compliance

HR compliance is the work of ensuring that your employment practices conform to federal, state, and local laws. This work requires learning which laws apply to your organization and understanding what they require you to do. That’s easier said than done.

HR compliance is truly an art. It requires knowledge, skill, and cooperation. You have to be able to decipher legalese, know where to go to ask and get the right answers and create policies and procedures that minimize business risk. You have to ensure that everyone from the executive team to newly minted managers know what they can and cannot do. You have to conduct investigations and enforce your rules consistently. And all this is just the bare minimum—necessary, but not enough to create a truly successful culture.

The work of compliance is never entirely done. Not only do new legal requirements appear frequently, but, as you’ll read below, compliance obligations are often unclear. While some compliance obligations are definitive, others are unresolved, and a good number require you to make a judgment call. Let’s look at each of these in turn.

Why HR Compliance Can’t Always Be Assured

Some employment laws take the form of “Do this” or “Don’t do that.” The requirements may be simple, like minimum wage, or complex, like FMLA, but either way there’s usually no real question about what you need to do or not do. Compliance with these laws is pretty straightforward. Don’t pay less than the minimum wage. Provide leave to eligible employees for the reasons that qualify, continue their health benefits (if applicable), and return them to their position when their leave ends. As long as you’re clear on the details, you’re not likely to lose sleep wondering if you’re compliant.

Sometimes, however, those details are unsettled. Lawmakers don’t always specify everything a law requires before it passes or takes effect. Even when laws seem clear, trying to put them into practice often raises a lot of questions. And the legislature isn’t the only source of law: regulatory agencies demand their say, and courts get involved, too. To complicate matters, these branches of government don’t always agree with each other, and what they say today may not be what they say tomorrow. Keeping up with the latest official guidance takes time and persistence. It can feel like a marathon, when what you want is a quick sprint to the answer. You have other demands on your time, after all.

Finally, a lot of employment laws have standards you have to follow, but they don’t tell you how. Neither the IRS nor the DOL, for example, tells you whether your workers are employees or independent contractors—unless there’s an audit or complaint. Instead, these agencies publish tests with general criteria that you use to make case-by-case determinations.

The Americans with Disabilities Act (ADA) works this way, too. The ADA requires employers to provide reasonable accommodations to employees with disabilities, with a few exceptions. One of the exceptions is that the accommodation doesn’t create an undue hardship on the employer’s business. The basic definition of an undue hardship is an action that creates a significant difficulty or expense. Although the law provides factors to consider in making this determination, the onus is on you to decide whether an expense or difficulty from an accommodation is significant. And, ultimately, your conclusion could be challenged in court.

Why HR Compliance Looks Like This

If HR compliance seems overly-complicated, that’s because it is. Our current legal landscape is the result of three competing philosophies about how the workplace should be governed, who should govern it, and whose rights in the workplace should be prioritized in the law.

Owner Control

According to the first view, business owners should have control over their workplaces for one simple reason. They own the business. It’s their property, and as owners they should have the legal right to govern it. Employees have no right to control aspects of the workplace because the workplace isn’t theirs. They don’t own it. It’s not their property. If they don’t like the terms and conditions of their employment, they can and should go elsewhere.

While an owner might employ managers or an executive team to make decisions about who to hire and fire, what to pay, how to assign work, and other such matters, the owner remains in charge. Advocates of this view include the economist, Milton Friedman. In 1970, he famously argued that corporate executives should bow to the desires of the owners. The will of the owners reigns supreme.

Worker Control

According to the second view, workers should have a say in the decisions that get made simply because those decisions affect them and their livelihoods. In this line of thinking, the governance of the workplace should adhere to the principles of democracy. However, proponents for this view differ on how democracy in the workplace should be practiced.

In the 1930s, Senator Robert F. Wagner introduced the National Labor Relations Act. He wanted to guarantee the “freedom of action of the worker” and ensure that workers were “free in the economic as well as the political field.” Today, talk of democratizing the workplace usually refers to bolstering unions. But there are other proposals to note. Some champions of workplace democracy, like Senator Elizabeth Warren, have pushed for employee representation on corporate boards. Others favor cooperative models in which the division between employers and employees doesn’t exist.

Full-fledged workplace democracy is still a fringe view, though. The very definition of an employee remains a worker who does not have the right to control what the work is, how it’s done, or how it’s compensated. Employees may be given authority to make decisions. They may have influence over their superiors. But they are not legally in charge.

Societal Control

Advocates of the third view argue that the government has an interest in exercising some measure of control over the work and the workplace. In the employer-employee relationship, employers typically have significantly more power than employees—especially an employee acting as an individual. Frances Perkins, who served as Secretary of Labor and was a key architect of the New Deal, believed that government “should aim to give all the people under its jurisdiction the best possible life.” She saw a role for legislatures in countering long hours, low wages, and other conditions unfavorable to employees.

How These Philosophies Have Played Out

In the United States, HR compliance is the result of these three competing and arguably incompatible philosophies. Government action with respect to employment has tried to empower workers and afford them certain rights, protections, and freedoms in the workplace, all while preserving the employer’s control over their business.

We can see this balancing act in the differences among state laws. Some states prioritize the right of owners to control their workforces and are loath to restrict that right through legislation. Other states act out of what they see as a duty to secure the rights of workers. Imposing obligations on employers doesn’t bother them.

We also see this balancing act in the way that employment laws tend to set parameters rather than dictate exactly what employers must do. You can pay employees whatever you want, so long as you pay at least the minimum, offer an overtime premium when applicable, and meet equal pay requirements. You can theoretically terminate employment for any reason or no reason at all (though we don’t recommend it); but you can’t fire someone for an illegal reason. Even laws that require a new practice, such as paid leave, allow flexibility provided you meet minimum conditions.

Takeaways

First, when you’re assessing your compliance obligations, understand that not all compliance obligations are clearly delineated or settled law. Unsettling as that may be, it’s how our system has been set up. In those cases, you’ll have to weigh your options and the risks involved, and then make a decision. Sometimes you may need legal advice in addition to HR guidance. Remember, however, that despite all the many employment laws on the books and in the imaginations of legislators, the system is designed to keep employers in charge. You can’t eliminate all risk, but by understanding the nuances and open questions, you can significantly minimize it.

Second, document your actions and decisions. It only takes an employee filing a complaint for enforcement agencies to get involved, but you are better protected if you can quickly and clearly explain to them the reason for your actions.

Third, evaluate whether your policies, procedures, and practices are satisfactory to employees. No employment law gets written in a vacuum, and no law is truly inevitable. Lawmakers passed the Fair Labor Standards Act because workers and the general public felt that labor standards were unfair. Today we wouldn’t have people pushing for predictive scheduling laws if they felt that work schedules were already sufficiently predictable. Harassment prevention training wouldn’t be mandatory (where it is) if sexual harassment weren’t widespread.

Fourth, lead by example. Make good employee relations a key part of your brand and competitive advantage. Employees have higher expectations today than they used to. Meet those expectations and motivate other employers to do the same, and you may find that the compliance landscape of the future is less winding and boggy than it could have been.

Finally, spend some time each day learning about your compliance obligations. Use resources that break down federal and state employment laws in a way that laypeople can understand. Keep up to speed on the latest compliance obligations and contingencies you should consider. HR compliance is an art. The first step to mastering it is learning what it entails and how it works.

Our tools are designed to streamline your workday.

Schedule a Demo and see how AllMyHR works for you.

Employment Law Updates: July 2021

Employment Law Updates: July 2021

One Federal and ten State Law Updates have been issued this month. Our HR Advisors are versed and ready to answer your toughest HR questions to help your company through working remotely, coming back to work and all year long.

Federal Labor Law Update for July 2021

1

OSHA’s National Emphasis Program for COVID-19 Revised and Interim Enforcement Response Plan Updated

On July 8, 2021, the U.S. Department of Labor’s Occupational Safety and Health Administration (OSHA) announced that it revised its National Emphasis Program (NEP) for COVID-19. OSHA launched the NEP on March 12, 2021, to focus on companies with the largest number of workers at serious risk of contracting COVID-19 and on employers that retaliate against employees who complain about unsafe or unhealthful conditions or exercise other rights under the Occupational Safety and Health Act.

The revised NEP:

- Adjusts the targeted industries to those most at risk for COVID-19 exposure, but still includes healthcare and non-healthcare, such as meat and poultry processing; and

- Removes an appendix that provided a list of Secondary Target Industries for the former COVID-19 NEP.

For inspections in healthcare, the revised NEP refers compliance safety and health officers (CSHOs) to the new directive, Inspection Procedures for the COVID-19 Emergency Temporary Standard, issued on June 28, 2021.

Inspections in non-healthcare establishments will follow procedures outlined in the Updated Interim Enforcement Response Plan (IERP) published July 7, 2021, it replaces the March 12, 2021 memorandum, and the updates include:

- Enforcing protections for workers in non-healthcare industries who are unvaccinated or not fully vaccinated;

- Where respirator supplies and services are readily available, OSHA will stop exercising enforcement discretion for temporary noncompliance with the Respiratory Protection standard based on employers’ claims of supply shortages due to the COVID-19 pandemic;

- OSHA will no longer exercise enforcement discretion for the same requirements in other health standards, where full compliance may have been difficult for some non-healthcare employers due to the COVID-19 pandemic;

- Updated instructions and guidance for OSHA area offices and CSHOs for handling COVID-19-related complaints, referrals and severe illness reports;

- Ensuring workers are protected from retaliation; and

- References to the revised NEP for COVID-19.

The IERPs goals are to identify exposures to COVID-19 hazards, ensure appropriate control measures are implemented, and address violations of OSHA standards (other than the ETS) and the General Duty Clause. The updated IERP will remain in effect until further notice and is intended to be time-limited to the current COVID-19 public health crisis.

The ETS became effective June 21, 2021. Healthcare employers must comply with most provisions by July 6, 2021, and with training, ventilation, and barrier provisions by July 21, 2021.

Individual state labor laws

State Specific Labor Law Updates:

Compliance can weigh down even the most experienced professionals. Our HR Advisors, one click compliance Handbook, Compliance Database, HR Tools and Employee Training are ready to help navigate HR all year long. Everything included with your AllMyHR Solutions.

Previous Labor Laws & Information

30-Day Money-Back Guarantee

Schedule A Demo

The simplest, most cost-effective way to streamline HR, reduce compliance risks, and focus on growing your business.

Contact Us Today©2025 AllMyHr Company. All Rights Reserved. Terms & Conditions. Website By Commonwealth Creative