On May 5, 2020, the U.S. Equal Employment Opportunity Commission (EEOC) updated the following technical assistance questions and answers addressing return to work and the Americans with Disabilities Act (ADA), the Rehabilitation Act, and other equal employment opportunity (EEO) laws:

(G.3) What does an employee need to do in order to request reasonable accommodation from their employer because they have one of the medical conditions that CDC says may put them at higher risk for severe illness from COVID-19? (updated 5/5/20)

An employee – or a third party, such as an employee’s doctor – must let the employer know that they need a change for a reason related to a medical condition (here, the underlying condition). Individuals may request accommodation in conversation or in writing. While the employee (or third party) does not need to use the term “reasonable accommodation” or reference the ADA, they may do so.

The employee or their representative should communicate that they have a medical condition that necessitates a change to meet a medical need. After receiving a request, the employer may ask questions or seek medical documentation to help decide if the individual has a disability and if there is a reasonable accommodation, barring undue hardship, that can be provided.

(G.4) The CDC identifies a number of medical conditions that might place individuals at “higher risk for severe illness” if they get COVID-19. An employer knows that an employee has one of these conditions and is concerned that his health will be jeopardized upon returning to the workplace, but the employee has not requested accommodation. How does the ADA apply to this situation? (5/7/20)

First, if the employee does not request a reasonable accommodation, the ADA does not mandate that the employer act.

If the employer is concerned about the employee’s health being jeopardized upon returning to the workplace, the ADA does not allow the employer to exclude the employee – or take any other adverse action – solely because the employee has a disability that the CDC identifies as potentially placing them at “higher risk for severe illness” if they get COVID-19. Under the ADA, such action is not allowed unless the employee’s disability poses a “direct threat” to their health that cannot be eliminated or reduced by reasonable accommodation.

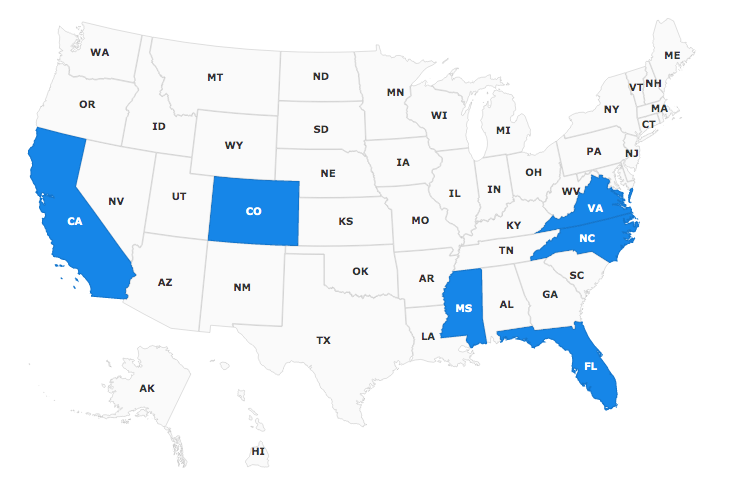

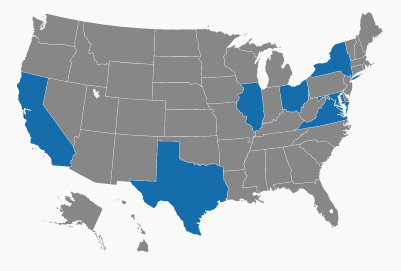

The ADA direct threat requirement is a high standard. As an affirmative defense, direct threat requires an employer to show that the individual has a disability that poses a “significant risk of substantial harm” to their own health under 29 CFR § 1630.2(r). A direct threat assessment cannot be based solely on the condition being on the CDC’s list; the determination must be an individualized assessment based on a reasonable medical judgment about this employee’s disability – not the disability in general – using the most current medical knowledge and/or on the best available objective evidence. The ADA regulation requires an employer to consider the duration of the risk, the nature and severity of the potential harm, the likelihood that the potential harm will occur, and the imminence of the potential harm. Analysis of these factors will likely include considerations based on the severity of the pandemic in a particular area and the employee’s own health (for example, is the employee’s disability well-controlled), and their particular job duties. A determination of direct threat also would include the likelihood that an individual will be exposed to the virus at the worksite. Measures that an employer may be taking in general to protect all workers, such as mandatory social distancing, also would be relevant.

Even if an employer determines that an employee’s disability poses a direct threat to his own health, the employer still cannot exclude the employee from the workplace – or take any other adverse action – unless there is no way to provide a reasonable accommodation (absent undue hardship). The ADA regulations require an employer to consider whether there are reasonable accommodations that would eliminate or reduce the risk so that it would be safe for the employee to return to the workplace while still permitting performance of essential functions. This can involve an interactive process with the employee. If there are not accommodations that permit this, then an employer must consider accommodations such as telework, leave, or reassignment (perhaps to a different job in a place where it may be safer for the employee to work or that permits telework). An employer may only bar an employee from the workplace if, after going through all these steps, the facts support the conclusion that the employee poses a significant risk of substantial harm to themselves that cannot be reduced or eliminated by reasonable accommodation.

(G.5) What are examples of accommodation that, absent undue hardship, may eliminate (or reduce to an acceptable level) a direct threat to self? (updated 5/5/20)

Accommodations may include additional or enhanced protective gowns, masks, gloves, or other gear beyond what the employer may generally provide to employees returning to its workplace. Accommodations also may include additional or enhanced protective measures, for example, erecting a barrier that provides separation between an employee with a disability and coworkers/the public or increasing the space between an employee with a disability and others. Another possible reasonable accommodation may be elimination or substitution of particular “marginal” functions (less critical or incidental job duties as distinguished from the “essential” functions of a particular position). In addition, accommodations may include temporary modification of work schedules (if that decreases contact with coworkers and/or the public when on duty or commuting) or moving the location of where one performs work (for example, moving a person to the end of a production line rather than in the middle of it if that provides more social distancing).

These are only a few ideas. Identifying an effective accommodation depends, among other things, on an employee’s job duties and the design of the workspace. An employer and employee should discuss possible ideas; the Job Accommodation Network (www.askjan.org) also may be able to assist in helping identify possible accommodations. As with all discussions of reasonable accommodation during this pandemic, employers and employees are encouraged to be creative and flexible.

See the updated questions and answers and all EEOC materials related to COVID-19.