Employment Law Updates: January 2022

Five Federal and eighteen State Law Updates have been issued this month. Our HR Advisors are versed and ready to answer your toughest HR questions to help your company through working remotely, coming back to work and all year long.

Federal Labor Law Updates:

1

2021 EEO-1 Component 1 Data Collection Tentatively Opens on April 12, 2022

The 2021 EEO-1 Component 1 data collection is tentatively scheduled to open on Tuesday, April 12th, 2022. The tentative deadline to file the 2021 EEO-1 Component 1 Report

is Tuesday, May 17th, 2022. Updates regarding the 2021 EEO-1 Component 1 data collection will be posted on this website as they become available.

Additionally, the Equal Employment Opportunity Commission (EEOC) is discontinuing the EEO-1 Component 1 Type 6 Establishment List Report for reporting establishments with fewer than 50 employees. Beginning with the 2021 EEO-1 Component 1 data collection, all filers reporting data for establishments with fewer than 50 employees must use a Type 8 Establishment Report to submit their data.

2

COVID and ADA

The Justice Department updated its Common Questions About COVID and the ADA to address the following COVID-era issues affecting people with disabilities:

Medical facilities’ visitor policies must account for the rights of people with disabilities to receive equal access to care; and outdoor retail or dining spaces (sometimes called “streateries”) must be accessible to people with disabilities and not prevent their use of sidewalks and accessible parking.

3

COVID-19 FAQs and Mandatory Coverage for Free OTC At-Home Tests by January 15, 2022

On January 10, 2022, the U.S. Department of Labor’s Employee Benefits Security Administration (EBSA) posted its FAQs regarding implementation of the Families First Coronavirus Response Act (FFCRA), the Coronavirus Aid, Relief, and Economic Security Act (CARES Act), and the Affordable Care Act. These FAQs were prepared jointly by the Departments of Labor, Health and Human Services, and the Treasury and—like previously issued FAQs here and here—answer questions about the laws and legal compliance.

Importantly, the new FAQs discuss the Biden-Harris administration’s requirement that insurance companies and group health plans cover the cost of over-the-counter (OTC), at- home COVID-19 tests, so people with private health coverage can get them for free starting January 15th. According to the Centers for Medicare and Medicaid Services, this new coverage requirement means that most consumers with private health coverage can go online or to a pharmacy or store, buy a test, and either get it paid for up front by their health plan, or get reimbursed for the cost by submitting a claim to their plan. This requirement incentivizes insurers to cover these costs up front and ensures individuals do not need an order from their health care provider to access these tests for free.

Beginning January 15, 2022, individuals with private health insurance coverage or covered by a group health plan who purchase an over-the-counter COVID-19 diagnostic test authorized, cleared, or approved by the U.S. Food and Drug Administration (FDA) will be able to have those test costs covered by their plan or insurance. Insurance companies and health plans are required to cover eight free over-the-counter at-home tests per covered individual per month. That means a family of four, all on the same plan, would be able to get up to 32 of these tests covered by their health plan per month. There is no limit on the number of tests, including at-home tests, that are covered if ordered or administered by a health care provider following an individualized clinical assessment, including for those who may need them due to underlying medical conditions.

Over-the-counter test purchases will be covered in the commercial market without the need for a health care provider’s order or individualized clinical assessment, and without any cost-sharing requirements such as deductibles, co-payments or coinsurance, prior authorization, or other medical management requirements.

As part of the requirement, the Administration is incentivizing insurers and group health plans to set up programs that allow people to get the over-the-counter tests directly through preferred pharmacies, retailers or other entities with no out-of-pocket

costs. Insurers and plans would cover the costs upfront, eliminating the need for consumers to submit a claim for reimbursement. When plans and insurers make tests available for upfront coverage through preferred pharmacies or retailers, they are still required to reimburse tests purchased by consumers outside of that network, at a rate of up to $12 per individual test (or the cost of the test, if less than $12). For example, if an individual has a plan that offers direct coverage through their preferred pharmacy but that individual instead purchases tests through an online retailer, the plan is still required to reimburse them up to $12 per individual test. Consumers can find out more information from their plan about how their plan or insurer will cover over-the-counter tests.

State Medicaid and Children’s Health Insurance Program (CHIP) programs are currently required to cover FDA-authorized at-home COVID-19 tests without cost-sharing. In 2021, the Biden-Harris Administration issued guidance explaining that State Medicaid and Children’s Health Insurance Program (CHIP) programs must cover all types of FDA- authorized COVID-19 tests without cost sharing under CMS’s interpretation of the American Rescue Plan Act of 2019 (ARP). Medicare pays for COVID-19 diagnostic tests performed by a laboratory, such as PCR and antigen tests, with no beneficiary cost sharing when the test is ordered by a physician, non-physician practitioner, pharmacist, or other authorized health care professional.

4

Supreme Court Halts OSHA ETS

The United States Supreme Court has halted the OSHA vaccine-or-test Emergency Temporary Standard (ETS). As a result, covered employers (those with 100 or more employees) are not currently required to comply with the ETS.

Employers should continue to comply with all other federal, state, and local requirements— this ruling only affects the OSHA ETS. If you’re in a state with an OSHA State Plan,

you should continue to keep an eye out for state OSHA requirements.

The Supreme Court ruling was limited to whether the stay should be put back in place. The case now returns to the Sixth Circuit Court of Appeals to determine whether the ETS is beyond OSHA’s authority. Based on the reasoning of the Supreme Court, which indicated that OSHA had overstepped its bounds by regulating public health generally rather

than just occupational health, it seems unlikely that the ETS will be revived. This post has been changed since its original publication.

5

Processing Vaccination Accommodation Requests under the ADA

On January 14, 2022, the Job Accommodation Network published Processing Vaccination Accommodation Requests under the Americans with Disabilities Act outlining a sample process for employers to determine whether they must grant a vaccination exception or delay as a reasonable accommodation under the ADA when employees are subject to a federal or state-imposed vaccination mandate or an employer policy. When an employee requests an accommodation and the disability and need for the accommodation are not obvious or already documented, the employer can require reasonable medical documentation. There is no required ADA medical documentation request form, but the Safer Federal Workforce provides a template for federal employers that can be modified by other employers as needed.

Is the employee unable to be vaccinated for COVID-19 because of a disability?

No: Deny the request under the ADA, apply other laws if appropriate, or follow usual policies.

Yes: Can the employee safely work while unvaccinated in the current job and work environment?

Yes: Allow the vaccination exception or delay.

No: Can accommodations be provided to eliminate or reduce exposure risk to an acceptable level, absent undue hardship?

Yes: Grant the vaccination exception or delay and provide the accommodations.

No: Deny the request under the ADA, apply other laws if appropriate, or follow usual policies.

More information is located at FAQ: COVID-19 Vaccination and the Americans with Disabilities Act.

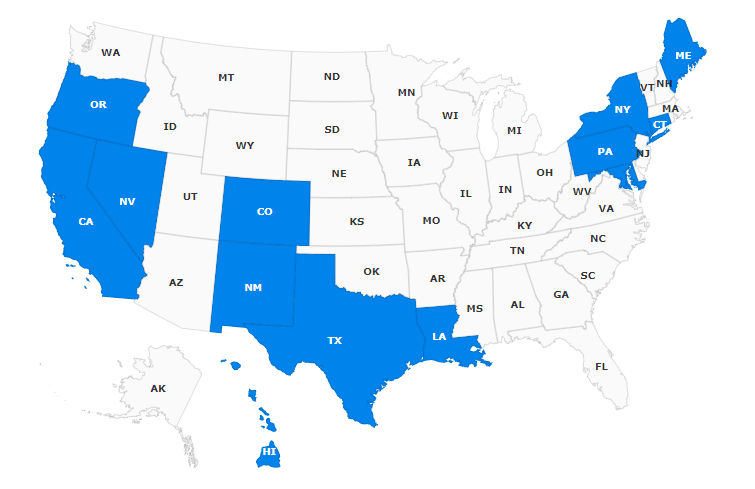

State Specific Labor Law Updates:

Compliance can weigh down even the most experienced professionals. Our HR Advisors, one click compliance Handbook, Compliance Database, HR Tools and Employee Training are ready to help navigate HR all year long. Everything included with your AllMyHR Solutions.