30-Day Money-Back Guarantee

Federal Law Updates: January 2021

Ten Federal along with D.C and three State Law Updates have been issued. Our HR Advisors are versed and ready to answer your toughest HR questions to help your company through working remotely, coming back to work and all year long.

Labor Law Updates for January 2021

1

CDC COVID-19 Workplace Testing Guidelines Emphasize Consent and Disclosure

The CDC updated guidance on COVID-19 Workplace testing.

On January 21, 2021, the Centers for Disease Control (CDC) updated its guidance on COVID-19 workplace testing. The guidance emphasizes that workplace-based testing should not be conducted without employees informed consent so they understand the testing process and may act independently to make choices that align with their values, goals, and preferences.

The guidance details the disclosures that an employer must provide to its employees, for instance:

- Test manufacturer, name, purpose, and type.

- How the test will be performed.

- Known and potential risks of harm, discomforts, and benefits of the test.

- What a positive or negative test result means, including:

- Test reliability and limitations; and

- Public health guidance to isolate or quarantine at home, if applicable.

The guidance also addresses topics employers should be prepared to discuss with their employees, such as test scheduling and payment, testing sites, communication and interpretation of results, employee privacy, and how to get assistance.

The CDC also provides a SARS-CoV-2 Testing Strategy: Considerations for Non-Healthcare Workplaces website, updated October 21, 2020, which identifies additional, important disclosures that employers should give to employees contemplating testing.

2

DOL Opinion Letters Addressing FLSA Exemptions and Worker Classification

The DOL released a new opinion letter addressing FLSA compliance.

On January 19, 2021, the U.S. Department of Labor released the following new opinion letters addressing Fair Labor Standards Act (FLSA) compliance:

- FLSA2021-6: Addressing whether the FLSA’s “retail or service establishment” exemption applies to staffing firms that recruit, hire, and place employees on assignments with clients.

- FLSA2021-7: Addressing whether certain local small-town and community news source journalists are creative or learned professionals under Section 13(a)(1) of the FLSA.

- FLSA2021-8: Addressing whether certain distributors of a manufacturer’s food products are employees or independent contractors under the FLSA.

FLSA2021-9: Addressing whether requiring tractor-trailer truck drivers to implement legally required safety measures creates control by the motor carrier for worker classification (employee or independent contractor) under the FLSA and whether certain owner-operators are correctly classified as independent contractors.

Back To Top

3

DOL Releases Opinion Letters for Two FLSA Topics: Tipped Workers and Establishment Workers

The DOL released an opinion letter regarding two FLSA topics.

On January 15, 2021, the U.S. Department of Labor released the following Fair Labor Standards Act (FLSA) opinion letters:

- FLSA 2021-5: This letter provided a step-by-step calculation of overtime pay under the FLSA when a tipped employee works as a server and bartender, receives tips, and also receives automatic gratuities or service charges.

- FLSA 2021-4: This letter found that a restaurant can implement a nontraditional tip pool under the FLSA’s new regulatory changes, not yet effective but set to be soon, so long as it does not include any managers or supervisors, the employer does not take a tip credit, and it pays the full minimum wage to both the tipped employees (servers) who contribute to the pool and the non-tipped employees (hosts or hostesses) who receive tips from the pool. A nontraditional tip pool includes both tipped employees and non-tipped employees.

FLSA 2021-3: This letter assessed three different entities and whether they satisfy the FLSA’s establishment requirement, which provides an exemption from minimum wage and overtime provisions for workers of an amusement or recreational establishment, and whether an accrual method of accounting may be used to satisfy the FLSA’s Receipts Test.

4

EEOC and Religious Discrimination Clarifications

The EEOC approved revisions to its Compliance Manual Section on Religious Discrimination.

On January 15, 2021, the U.S. Equal Employment Opportunity Commission (EEOC) approved revisions to its Compliance Manual Section on Religious Discrimination. The updated guidance describes how Title VII of the Civil Rights Act of 1964 protects against religious discrimination in the workplace and details legal protections available to religious employers. Importantly, the EEOC states that “the manual does not have the force and effect of law and is not meant to bind the public in any way. It is intended to provide clarity to the public on existing requirements under the law and how the EEOC will analyze these matters in performing its duties.”

5

Replacement Sticker Extending Permanent Resident Card (Green Card) Validity and Form I-9

The USCIS announces it is replacing the current sticker extending the validity of a Form I-551, PRC or Green Card.

On January 12, 2021, the U.S. Citizenship and Immigration Services (USCIS) announced that it is replacing the currently issued sticker that extends the validity of a Form I-551, Permanent Resident Card (PRC), or Green Card, with a revised Form I-797, Notice of Action, receipt notice of Form I-90, Application to Replace Permanent Resident Card. The revised notice will extend the validity of a PRC for 12 months from the “Card Expires” date on the front of the PRC. This change ensures that certain lawful permanent residents have documentation for completing Form I-9, Employment Eligibility Verification.

Employees may present their expired PRC together with this notice as an acceptable List A document that establishes identity and employment authorization for Form I-9 purposes. When completing a Form I-9, employers should enter the information from this document combination in Section 2, under List A:

- In the Document Number field, enter the card number provided on the expired PRC.

- In the Expiration Date field, enter the date that is 12 months from the “Card Expires” date on the expired PRC.

- In the Additional Information box, write “PRC Ext” and the I-90 receipt number from the Form I-797.

Employers who retain copies of documents should retain copies of both the PRC and Form I-797 with the employee’s Form I-9. Employers may not reverify Lawful Permanent Residents who present this document combination.

Read more about acceptable documents at I-9 Central or in The Handbook for Employers, Guidance for Completing Form I-9.

6

FLSA Opinion Letters: Administrative Employee Exemption and Ministerial Exception

The U.S. DOL announces new opinion letter related to the FLSA.

On January 8, 2021, the U.S. Department of Labor announced the following new opinion letters that provide compliance assistance related to the federal Fair Labor Standards Act (FLSA):

- FLSA2021-1: Addressing whether account managers at a life science products manufacturer qualify for the administrative employee exemption under the FLSA. The DOL concluded that the account managers were administrative employees because they met all three requirements, discussed thoroughly in the letter, necessary to qualify for the exemption (from the FLSA minimum wage and overtime pay requirements).

FLSA2021-2: Addressing whether the ministerial exception allows a private religious daycare and preschool to pay its teachers on a salary basis that would not otherwise conform with the requirements of the FLSA. The DOL concluded that the exception would allow the school to do so if the teachers qualify as ministers.

7

OSHA Penalty Amount Increases

The U.S. DOL announces adjustments to the OSHA.

On January 8, 2021, the U.S. Department of Labor announced the following 2021 adjustments to the Occupational Safety and Health Administration (OSHA) civil penalty amounts:

- Serious violations: minimum of $964 per violation and maximum of $13,653 per violation.

- Other-than-serious violations: minimum of $0 per violation and maximum of $13,653 per violation.

- Willful or repeated violations: minimum of $9,639 per violation and maximum of $136,532 per violation.

- Posting requirements violations: minimum of $0 per violation and maximum of $13,653 per violation.

- Failure to abate violation: $13,653 per day unabated beyond the abatement date, which is generally limited to 30 days maximum.

These increases apply to penalties assessed after January 15, 2021.

8

Final Rule Clarifies Independent Contractor Status under the Fair Labor Standards Act

DOL announces a final rule clarifying employee vs. independent contractor under the FLSA.

On January 6, 2021, the U.S. Department of Labor, Wage and Hour Division announced a final rule clarifying whether an individual is an employee or an independent contractor under the Fair Labor Standards Act (FLSA). The rule:

- Reaffirms the “economic reality” test which determines whether an individual is in business for themselves (independent contractor) or is economically dependent on a potential employer for work (FLSA employee).

- Identifies and explains two core factors to determine whether a worker is economically dependent on someone else’s business (employee) or is in business for themselves (independent contractor):

- The nature and degree of control over the work; and

- The worker’s opportunity for profit or loss based on initiative and/or investment.

If those two primary core factors do not point to the same classification, then the rule identifies the following additional factors to determine status:

- The amount of skill required for the work;

- The degree of permanence of the working relationship between the worker and the potential employer; and

- Whether the work is part of an integrated unit of production.

The rule also:

- Identifies that the actual practice of the worker and the potential employer is more relevant than what may be contractually or theoretically possible.

- Provides six fact-specific examples applying the factors.

The rule is effective March 8, 2021.

9

COVID-19 Relief for Employers Using the Automobile Lease Valuation Rule

DOL announces a final rule clarifying employee vs. independent contractor under the FLSA.

On January 4, 2021, the Internal Revenue Service released Notice 2021-07 which provides temporary relief in response to the ongoing COVID-19 pandemic for employers using the automobile lease valuation rule to value an employee’s personal use of an employer-provided automobile for:

- Income inclusion;

- Employment tax; and

- Reporting.

Due solely to the COVID-19 pandemic, if certain requirements are satisfied, employers and employees using the automobile lease valuation rule to determine the value of an employee’s personal use of an employer-provided automobile may instead use the vehicle cents-per-mile valuation rule beginning March 13, 2020.

10

2021 IRS Forms

New publications and forms released by the IRS.

On December 31, 2020 and January 5, 2021, the federal Internal Revenue Service released the following new forms and publications, among many others, for use in 2021:

- Form W-4 – Employee’s Withholding Certificate

- Form W-4P – Withholding Certificate for Pension or Annuity Payments

- Publication 531 – Reporting Tip Income

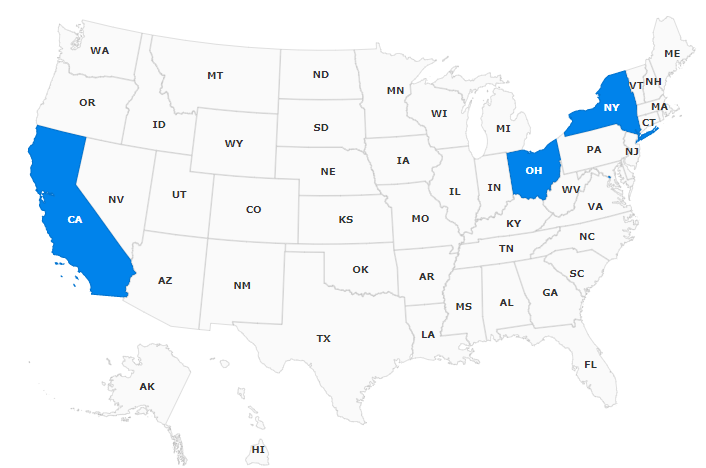

Individual state labor laws

State Specific Labor Law Updates:

Compliance can weigh down even the most experienced professionals. Our HR Advisors, one click compliance Handbook ,Compliance Database, HR Tools and Employee Training are ready to help navigate HR all year long. Everything included with your AllMyHR™ Solutions.