Use Code: CVD19 for 14 Days Free

Federal & State Employment Law Updates: August 2020

Six States and the District of Columbia have updated their employment laws so far this month, alongside one Federal Law Update. Our HR Advisors are versed and ready to answer your toughest HR questions to help your company through working remotely, coming back to work and all year long.

Labor Law Updates for August 2020

1

Telework and Work Hours

Guidance addressing employers obligation to track teleworking employees compensable hours.

On August 24, 2020, the U.S. Department of Labor released Field Assistance Bulletin No. 2020-5 to address employers’ obligation under the Fair Labor Standards Act (FLSA) to track teleworking employees compensable work hours.

Although the guidance is specific to the COVID-19 pandemic, it also applies to other telework or remote work arrangements and reaffirms that an employer must pay its employees for all hours worked, including work not requested but allowed and work performed at home.

Additionally, an employer’s obligation to compensate employees for hours worked can be based on their actual or constructive knowledge of that work. For instance, with telework and remote work employees, an employer:

- Has actual knowledge of the employees’ regularly scheduled hours; and

- May have actual knowledge of hours worked through employee reports or other notifications.

For overtime, an employer may establish constructive knowledge of their employees’ unscheduled hours by exercising reasonable diligence and establishing a process for employees to report their extra time. If an employee fails to report unscheduled hours through such a procedure, the employer is generally not required to investigate further to uncover unreported hours. However, if an employer is otherwise notified through a reasonable method, or if employees are not properly instructed on using a reporting system, then an employer may be liable for those hours worked.

2

Form I-9 Compliance Flexibility Extended to September 19

Another extension to the flexibility rules for Form I-9 compliance.

On August 18, 2020, the Department of Homeland Security (DHS) and U.S. Immigration and Customs Enforcement (ICE) announced another extension to the Employment Eligibility Verification (Form I-9) flexibility rule, which has been extended to September 19, 2020, due to necessary COVID-19 precautions. This flexibility rule, applicable only to remote workplaces, defers the physical presence requirements for in-person verification of identity and employment eligibility documentation for Form I-9. If there are employees physically present at the workplace, then there is no exception for in-person verification.

On March 19, 2020, the DHS first announced that the physical presence requirements were deferred due to COVID-19. Employers are required to monitor the DHS and ICE websites for additional updates regarding when the extensions will be terminated and when normal operations will resume.

3

ADA and Opioid Abuse

The EEOC released guidancde addressing the use of codeine, oxycodone, and other opiods.

On August 5, 2020, the federal Equal Employment Opportunity Commission (EEOC) released a guidance addressing employees and the use of codeine, oxycodone, and other opioids. This guidance explains the nondiscrimination and reasonable accommodation provisions of the Americans with Disabilities Act (ADA) that are applicable those not engaged in current, illegal drug use and who are qualified for employment. This information is not new policy, instead it applies principles already established in the ADA, clarifies existing legal requirements, and discusses the following:

- Disqualification from a job for opioid use, legal use of opioids, and drug testing;

- On the job performance and safety when using opioids, reasonable accommodations, and addiction; and

- Employee rights and legal process when a violation occurs.

4

Accommodation Strategies for Returning to Work During the COVID-19 Pandemic

Strategies to assist employers in accommodating employees with disabilities and return to work during the COVID-19 pandemic.

On August 3, 2020, the Job Accommodation Network (JAN) posted a blog with strategies covering the following topics to assist employers in accommodating employees with disabilities and their return to work during the COVID-19 pandemic:

- General solutions for limiting the risk of exposure to COVID-19;

- Solutions to address physical distancing needs; and

- Solutions to address communication needs.

However, JAN reminds employers that in some cases it will be necessary to analyze the individual circumstances to provide customized reasonable accommodation solutions.

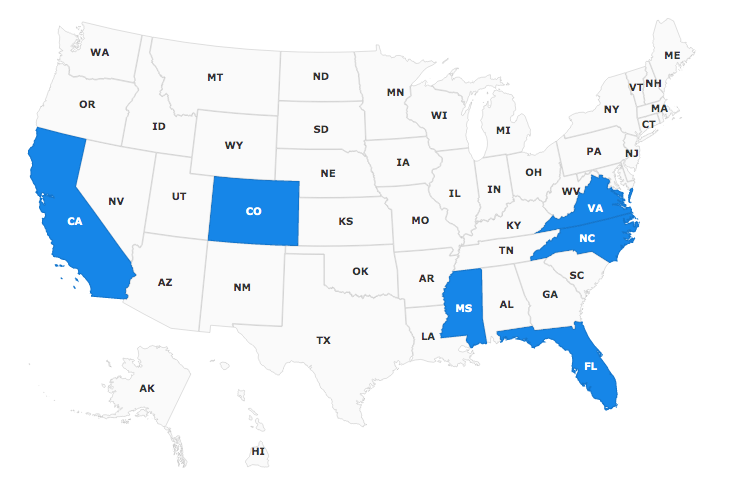

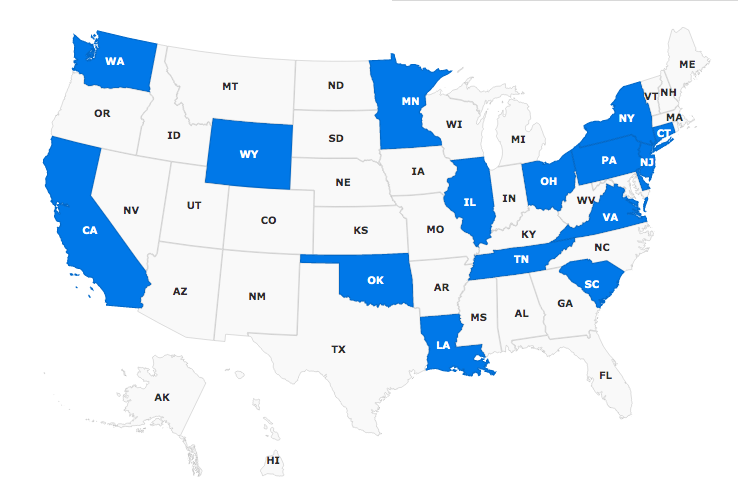

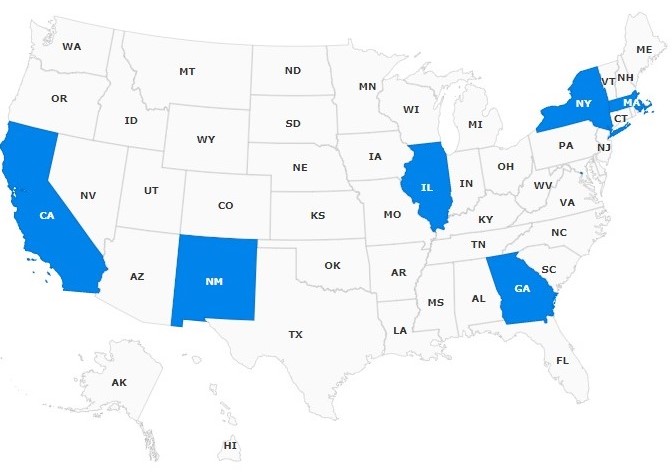

Individual State Labor Laws

State Specific Labor Law Updates:

Compliance can weigh down even the most experienced professionals. Our HR Advisors, one click compliance Handbook ,Compliance Database, HR Tools and Employee Training are ready to help navigate HR all year long. Everything included with your AllMyHR™ Solutions.