Use Code: CVD19 for 14 Days Free

Federal & State Employment Law Updates: May 2020

Seven States have updated their employment laws so far this month, alongside sixteen Federal Law Updates. Our HR Advisors are versed and ready to answer your toughest HR questions to help your company through working remotely, coming back to work and all year long.

Labor Law Updates for May 2020

1

OSHA Revised COVID-19 Case Reporting and Updated Response Plan

An emergency declaration regarding suspensions of regulations for permissible drive times for commercial drivers.

On May 19, 2020, the Occupational Safety and Health Administration (OSHA) revised its enforcement guidance for recording COVID-19 cases. On May 26, 2020, the previous memo on this topic will be rescinded, and this new memorandum goes into and remains in effect until further notice. Under OSHA’s recordkeeping requirements, COVID-19 is a recordable illness, and thus employers are responsible for recording cases of it, if:

- The case is a confirmed case of COVID-19, as defined by the Centers for Disease Control and Prevention (CDC);

- The case is work-related; and

- The case involves one or more of the general recording criteria.

In addition, OSHA updated its interim enforcement response plan for COVID-19 with instructions and guidance to Area Offices and compliance safety and health officers (CSHOs) for handling COVID-19-related complaints, referrals, and severe illness reports. On May 26, 2020, the previous memo on this topic will be rescinded, and this new update goes into and remains in effect until further notice. As workplaces reopen, OSHA will continue to ensure safe and healthy conditions pursuant to the following framework:

- In areas where community spread of COVID-19 has significantly decreased, OSHA will return to its pre-COVID-19 inspection planning policy when prioritizing reported events for inspections, except that:

- OSHA will continue to prioritize COVID-19 cases;

- OSHA will utilize non-formal phone/fax investigations or rapid response investigations in circumstances where it has historically performed such inspections (e.g., to address formal complaints) when necessary to assure effective and efficient use of resources to address COVID-19-related events; and

- In all instances, CSHOs must utilize the appropriate precautions and personal protective equipment (PPE) when performing COVID-19-related inspections.

- In areas where there is sustained elevated community transmission or a resurgence in community transmission of COVID-19, Area Directors will exercise their discretion, including consideration of available resources, to:

- Continue prioritizing COVID-19 fatalities and imminent danger exposures for inspection. Particular attention for on-site inspections will be given to high-risk workplaces, such as hospitals and other healthcare providers treating patients with COVID-19, as well as workplaces, with high numbers of complaints or known COVID-19 cases. In addition:

- Where resources do not allow for on-site inspections, the inspections will be initiated remotely with an expectation that an on-site component will be performed if/when resources become available.

- Where neither an on-site nor remote inspection is possible, OSHA will investigate using a rapid response investigation to identify any hazards, provide abatement assistance, and confirm abatement.

- OSHA will develop a program to conduct monitoring inspections from a randomized sampling of fatality or imminent danger cases where inspections were not conducted due to resource limitations.

- Utilize non-formal phone/fax investigation instead of an on-site inspection in industries where doing so can address the relevant hazard(s).

- Ensure that CSHOs utilize the appropriate precautions and personal protective equipment to protect against potential exposures to COVID-19.

- Continue prioritizing COVID-19 fatalities and imminent danger exposures for inspection. Particular attention for on-site inspections will be given to high-risk workplaces, such as hospitals and other healthcare providers treating patients with COVID-19, as well as workplaces, with high numbers of complaints or known COVID-19 cases. In addition:

Both the guidance and plan are intended to be time-limited to the current COVID-19 public health crisis.

2

Paycheck Protection Program Loan Forgiveness Application

On May 15, 2020, the Small Business Administration (SBA) released the Paycheck Protection Program (PPP) loan forgiveness application, with instructions, to inform borrowers about applying for forgiveness of their PPP loans at the conclusion of the eight-week covered period, which began with the disbursement of their loans. The PPP was created by the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) to provide forgivable loans to eligible small businesses to keep workers on the payroll during the COVID-19 pandemic.

The form and instructions include:

- Options for borrowers to calculate payroll costs using an “alternative payroll covered period” that aligns with their regular payroll cycles.

- Flexibility to include eligible payroll and non-payroll expenses paid or incurred during the eight-week period after receiving their PPP loan.

- Instructions on how to complete the calculations required by the CARES Act to confirm eligibility for loan forgiveness.

- Statutory exemptions from loan forgiveness reduction based on rehiring by June 30.

- A new exemption from the loan forgiveness reduction for borrowers who made a good-faith, written offer to rehire workers, which was declined.

View the application and instructions.

3

Workplace Decision Tree and COVID-19

The Centers for Disease Control and Prevention (CDC) released a workplace decision tree to assist employers in making reopening decisions during the COVID-19 pandemic. The tool walks employers through the following steps:

- Whether they should consider reopening;

- If they plan to reopen, whether recommended health and safety actions are in place; and

- If in place, how they can ensure ongoing monitoring for maintaining safety.

If employers cannot answer “yes” to the questions posed in the tool, the CDC recommends that they reassess and meet the necessary safeguards prior to reopening. The CDC also reminds employers to check with their state and local health officials to determine the most appropriate actions while adjusting to meet the needs and circumstances of their local community.

See the decision tree.

4

Overtime and Fluctuating Workweek

On May 20, 2020, the U.S. Department of Labor (DOL) announced a final rule allowing employers to pay bonuses, premium payments, or other additional pay, such as commissions and hazard pay, to employees compensated using the fluctuating workweek method of compensation. For overtime purposes, these supplemental payments must be included in the calculation of the regular rate unless they are excludable under the federal Fair Labor Standards Act (§§ 7(e)(1) – (8)). Currently, this fluctuating workweek method may not be used by employers who compensate their employees with bonuses or other incentive-based pay.

Background

The Fair Labor Standards Act (FLSA) requires that employers pay their nonexempt employees overtime of at least one and one-half times their regular rate for all hours worked over 40 in a workweek. The regular rate is computed for each workweek and is all remuneration for employment, with some exclusions, divided by the number of hours worked. The regular rate is determined by dividing the total pay in any workweek by the total number of hours actually worked.

Fluctuating Workweek Method

The fluctuating workweek method allows employers to calculate overtime pay for nonexempt employees who are paid a fixed salary for hours that vary each week. Specifically, an employer may use this method to compute overtime compensation when:

- The employee’s work hours fluctuate from week to week;

- The employee receives a fixed salary that does not vary with the number of hours they work in the workweek, whether few or many;

- The amount of the employee’s fixed salary is enough to pay them at least the applicable minimum wage for every hour they worked in workweeks when they worked the most hours;

- The employee and the employer have a clear and mutual understanding that the employee’s fixed salary is compensation (apart from overtime premiums and any bonuses, premium payments, commissions, hazard pay, or other additional pay of any kind not excludable from the regular rate under FLSA §§ 7(e)(l) – (8) for the total hours worked each workweek regardless of the number of hours; and

- The employee receives overtime pay, in addition to their fixed salary and any bonuses, premium payments, commissions, hazard pay, and additional pay of any kind, for all overtime hours worked at no less than one-half the employee’s regular rate of pay for that workweek.

Since the salary is fixed, an employee’s regular rate will vary from week to week and is determined by dividing the amount of the salary and any non-excludable additional pay received each workweek by the number of hours worked in the workweek.

Payment for overtime hours, at no less than one-half of this rate, is compliant because these hours have already been compensated at the straight time rate (by payment of the fixed salary and non-excludable additional pay). Payment of any bonuses, premium payments, commissions, hazard pay, and additional pay of any kind is compatible with the fluctuating workweek method of overtime payment, and such payments must be included in the calculation of the regular rate unless excludable under § 7(e)(1) through (8).

Scenario and Example

The DOL provides the following scenario and example to demonstrate overtime and a fluctuating workweek:

Scenario: An employee whose hours of work do not customarily follow a regular schedule but vary from week to week, whose work hours never exceed 50 hours in a workweek, and whose salary of $600 a week is paid with the understanding that it constitutes the employee’s compensation (apart from overtime premiums and any bonuses, premium payments, commissions, hazard pay, or other additional pay of any kind not excludable from the regular rate under §§ 7(e)(1) – (8)) for all hours worked in the workweek.

Example: If during the course of four weeks this employee receives no additional compensation and works 37.5, 44, 50, and 48 hours, the regular rate of pay in each of these weeks is $16, $13.64, $12, and $12.50, respectively. Since the employee has already received straight time compensation for all hours worked in these weeks, only additional half-time pay is due for overtime hours. For the first week the employee is owed $600 (fixed salary of $600, with no overtime hours); for the second week $627.28 (fixed salary of $600, and 4 hours of overtime pay at one-half times the regular rate of $13.64 for a total overtime payment of $27.28); for the third week $660 (fixed salary of $600, and 10 hours of overtime pay at one-half times the regular rate of $12 for a total overtime payment of $60); for the fourth week $650 (fixed salary of $600, and 8 overtime hours at one-half times the regular rate of $12.50 for a total overtime payment of $50).

The DOL included a disclaimer that this final rule was submitted to the Office of the Federal Register (OFR) for publication, and is currently pending placement upon public inspection at the OFR and publication in the Federal Register. The current version of the final rule may vary from the published version if minor technical or formatting changes are made during the OFR review process. Importantly, only the version published in the Federal Register is the official final rule.

The final rule is effective 60 days after final publication.

Read the announcement and final rule.

5

DOL and Commissioned Sales Overtime Exemption

On May 18, 2020, the U.S. Department of Labor’s Wage and Hour Division (WHD) modified its former interpretation of the Fair Labor Standards Act’s overtime exemption for primarily commission-based employees of retail or service employers (§ 7(i) exemption). To meet the commissioned sales overtime exemption, a worker:

- Must be employed in a “retail or service” establishment;

- Must earn at least 1.5 times the minimum wage; and

- More than half their compensation for a representative period (not less than one month) must represent commissions.

In 1961 and 1970, the Department of Labor (DOL) released two interpretive rules with long lists of businesses that were not retail (“no retail concepts”) or might be retail (“may be recognized as retail”). These lists, although not binding on the courts, created flexibility in commissioned employees’ overtime entitlement by more broadly interpreting whether the employee was actually working for a “retail or service” employer (and thus entitled to overtime compensation). The DOL’s recent modification eliminated the aforementioned lists and instead will apply a single standard when determining whether an establishment is “retail or service”:

“Retail or service establishments sell goods or services to the general public, serve the everyday needs of the community, are at the very end of the stream of distribution, dispose their products and skills in small quantities, and do not take part in the manufacturing process.” (29 C.F.R. § 779.318(a))

As a result, more commission-based workers may be exempt from the FLSA overtime requirements because this recent interpretation treats their employer as a “retail or service” establishment.

The WHD issued this rule without notice or comment, and it took immediate effect.

Read the final rule and fact sheet.

6

Department of Labor’s COVID-19 Updates

On May 15, 2020, the U.S. Department of Labor (DOL) announced all of the following COVID-19 updates and resources:

- Up to $100 million will be made available for states to implement or improve short-time compensation programs, which aim to avoid layoffs by reducing hours for a group of workers.

- Additional guidance for states on the Federal Pandemic Unemployment Compensation Program.

- Guidance and reminders to help states ensure the integrity of their unemployment insurance programs.

- Occupational Safety and Health Administration (OSHA) alert on protecting dental industry workers.

- OSHA alert on protecting rideshare and taxi workers

- OSHA alert on protecting retail pharmacy workers.

- Information on the Pandemic Emergency Unemployment Compensation program for states updated.

- OSHA video demonstrating the proper use of respirators in Spanish.

- Fact sheets, FAQs, posters, webinars and more to help employers comply with the paid leave requirements of the Families First Coronavirus Response Act.

- DOL COVID-19 tips, updates, and resources.

7

Form I-9 Compliance Flexibility Extended

On May 14, 2020, the U.S. Immigration and Customs Enforcement (ICE) announced an extension of rules allowing employers flexibility in Form I-9 compliance. Under the rules, employers may forego the requirement that an employee’s identity and employment authorization documents (Form I-9 Section 2 documents) be reviewed in the employee’s physical presence. This in-person flexibility was permitted because many employers and employees were taking physical proximity precautions due to COVID-19. Instead, employers must take the following actions to verify an employee’s identity and employment authorization via Section 2 documents:

- Inspect the Section 2 documents remotely (over video link, fax, or email); and

- Obtain, inspect, and retain copies of these documents within three business days.

This flexibility in identity and authorization documents only applies to employers and workplaces that are operating remotely. The May 14 announcement extends the flexibility for an additional 30 days (it was set to expire on May 19) in response to the need for continued COVID-19 precautions.

Additionally, effective March 19, 2020, employers who were served notices of inspection from ICE during the month of March 2020, and did not respond, were granted an automatic extension for 60 days from the effective date. ICE will grant an additional 30-day extension for these employers as well, if needed.

Read the announcement and original guidance.

8

Payroll Protection Program and Employee Retention Credits

On May 7, 2020, the Internal Revenue Service (IRS) updated its frequently asked questions (FAQs) about the Payroll Protection Program (PPP) and the Employee Retention Credit under the Cares Act. The Employee Retention Credit (ERC) is a tax credit equal to 50 percent of the qualified wages that eligible employers paid to employees (up to $5,000 per employee) after March 12, 2020 and before January 1, 2021. Employers that receive a PPP loan are not qualified for the ERC.

The IRS clarified in its updated FAQ that an employer that repays its PPP loan by May 14, 2020 will be treated as though they did not receive it and may still receive the ERC (if otherwise eligible). This updated FAQ is important because the repayment date was originally May 7, 2020.

See the FAQs and read about the Employee Retention Credit.

9

EEOC, COVID-19, ADA, the Rehabilitation Act, and Other EEO Laws

On May 5, 2020, the U.S. Equal Employment Opportunity Commission (EEOC) updated the following technical assistance questions and answers addressing return to work and the Americans with Disabilities Act (ADA), the Rehabilitation Act, and other equal employment opportunity (EEO) laws:

(G.3) What does an employee need to do in order to request reasonable accommodation from their employer because they have one of the medical conditions that CDC says may put them at higher risk for severe illness from COVID-19? (updated 5/5/20)

An employee – or a third party, such as an employee’s doctor – must let the employer know that they need a change for a reason related to a medical condition (here, the underlying condition). Individuals may request accommodation in conversation or in writing. While the employee (or third party) does not need to use the term “reasonable accommodation” or reference the ADA, they may do so.

The employee or their representative should communicate that they have a medical condition that necessitates a change to meet a medical need. After receiving a request, the employer may ask questions or seek medical documentation to help decide if the individual has a disability and if there is a reasonable accommodation, barring undue hardship, that can be provided.

(G.4) The CDC identifies a number of medical conditions that might place individuals at “higher risk for severe illness” if they get COVID-19. An employer knows that an employee has one of these conditions and is concerned that his health will be jeopardized upon returning to the workplace, but the employee has not requested accommodation. How does the ADA apply to this situation? (5/7/20)

First, if the employee does not request a reasonable accommodation, the ADA does not mandate that the employer act.

If the employer is concerned about the employee’s health being jeopardized upon returning to the workplace, the ADA does not allow the employer to exclude the employee – or take any other adverse action – solely because the employee has a disability that the CDC identifies as potentially placing them at “higher risk for severe illness” if they get COVID-19. Under the ADA, such action is not allowed unless the employee’s disability poses a “direct threat” to their health that cannot be eliminated or reduced by reasonable accommodation.

The ADA direct threat requirement is a high standard. As an affirmative defense, direct threat requires an employer to show that the individual has a disability that poses a “significant risk of substantial harm” to their own health under 29 CFR § 1630.2(r). A direct threat assessment cannot be based solely on the condition being on the CDC’s list; the determination must be an individualized assessment based on a reasonable medical judgment about this employee’s disability – not the disability in general – using the most current medical knowledge and/or on the best available objective evidence. The ADA regulation requires an employer to consider the duration of the risk, the nature and severity of the potential harm, the likelihood that the potential harm will occur, and the imminence of the potential harm. Analysis of these factors will likely include considerations based on the severity of the pandemic in a particular area and the employee’s own health (for example, is the employee’s disability well-controlled), and their particular job duties. A determination of direct threat also would include the likelihood that an individual will be exposed to the virus at the worksite. Measures that an employer may be taking in general to protect all workers, such as mandatory social distancing, also would be relevant.

Even if an employer determines that an employee’s disability poses a direct threat to his own health, the employer still cannot exclude the employee from the workplace – or take any other adverse action – unless there is no way to provide a reasonable accommodation (absent undue hardship). The ADA regulations require an employer to consider whether there are reasonable accommodations that would eliminate or reduce the risk so that it would be safe for the employee to return to the workplace while still permitting performance of essential functions. This can involve an interactive process with the employee. If there are not accommodations that permit this, then an employer must consider accommodations such as telework, leave, or reassignment (perhaps to a different job in a place where it may be safer for the employee to work or that permits telework). An employer may only bar an employee from the workplace if, after going through all these steps, the facts support the conclusion that the employee poses a significant risk of substantial harm to themselves that cannot be reduced or eliminated by reasonable accommodation.

(G.5) What are examples of accommodation that, absent undue hardship, may eliminate (or reduce to an acceptable level) a direct threat to self? (updated 5/5/20)

Accommodations may include additional or enhanced protective gowns, masks, gloves, or other gear beyond what the employer may generally provide to employees returning to its workplace. Accommodations also may include additional or enhanced protective measures, for example, erecting a barrier that provides separation between an employee with a disability and coworkers/the public or increasing the space between an employee with a disability and others. Another possible reasonable accommodation may be elimination or substitution of particular “marginal” functions (less critical or incidental job duties as distinguished from the “essential” functions of a particular position). In addition, accommodations may include temporary modification of work schedules (if that decreases contact with coworkers and/or the public when on duty or commuting) or moving the location of where one performs work (for example, moving a person to the end of a production line rather than in the middle of it if that provides more social distancing).

These are only a few ideas. Identifying an effective accommodation depends, among other things, on an employee’s job duties and the design of the workspace. An employer and employee should discuss possible ideas; the Job Accommodation Network (www.askjan.org) also may be able to assist in helping identify possible accommodations. As with all discussions of reasonable accommodation during this pandemic, employers and employees are encouraged to be creative and flexible.

See the updated questions and answers and all EEOC materials related to COVID-19.

Download the Other 7 Federal Law Updates

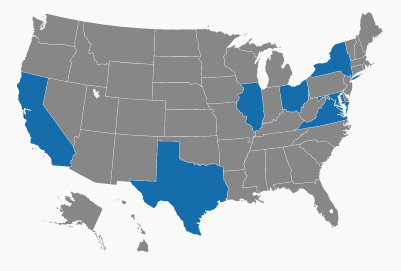

Individual State Labor Laws

State Specific Labor Law Updates:

Compliance can weigh down even the most experienced professionals. Our HR Advisors, automatically updating Handbook, Compliance Database, HR Tools and Employee Training are ready to help navigate HR all year long. Everything included with your AllMyHR™ Solutions.

Previous Labor Laws & Information

AllMyHR

Schedule A Demo

The simplest, most cost-effective way to streamline HR, reduce compliance risks, and focus on growing your business.

Contact Us Today©2025 AllMyHr Company. All Rights Reserved. Terms & Conditions. Website By Commonwealth Creative

Limited Time Offer

Is HR working for you—or against you?

Start your subscription today. Cancel anytime.

Stay Compliant, Avoid Risk

Access to Certified HR Experts

Compliant, Living Handbook